Date recorded: March 15, 2023

Listen on Itunes, Spotify, or watch on Youtube.

Hey friends 👋

Another week, another podcast. In this episode, I sat down with EquityMultiple CEO, Charles Clinton, to learn about his journey starting the online crowdfunding platform, and dive into what EquityMultiple is all about. I’ve looked at a few real estate crowdfunding platforms now (CityVest, HoneyBricks), and thought EquityMultiple would be “just another one to add to the list,” but boy was I wrong. I left the interview impressed by Charles and what he’s built. I'm sure you will too.

How could I not be? The numbers speak for themselves:

17% average annual return from 84 deals exited since inception

$4.4B in total project value

$298M distributed to investors (as of the end of 2022)

40,000+ users

What exactly is EquityMultiple?

EquityMultiple is a commercial real estate crowdfunding platform that provides accredited investors access to private real estate transactions across property types and risk profiles at as little as $5,000. They specialize in individual properties with a focus on multifamily and industrial, but have also done projects in hospitality, hotels, car washes, retail and office.

Outside of being a technology-driven investment platform making real estate investing easy from the comfort of your computer (and their track record off course), there are 3 things that really stood out to me about EquityMultiple:

Professionally-managed: EquityMultiple is hands-on. They have a strong team that conducts private equity-style due diligence and asset manages the property on behalf of the investor throughout the life of the investment.

Diverse product offering: Their focus is to help you diversify. From short-term to long-term, from debt to equity, EquityMultiple has you covered. They have a variety of investment options that suit different investor needs and risk profiles.

High-quality institutional-grade deals: Being an online platform raising money from retail investors, you might assume EquityMultiple doesn’t get the best deals. On the contrary, they are able to provide access to institutional-grade deals for 2 reasons:

Focus on middle-market deals (below $50M) where capital is inefficient

To sponsors / lenders they fund, EquityMultiple operate more like an institutional investor with reliable capital - they commit to funding deals based on deal quality, not whether they are able to raising capital

They use the collective bargaining power of their investors to command oversight over sponsors

Insights from Charles

Interviewing Charles about his journey starting EquityMultiple, his insights on the market, and his personal investment lessons was truly educational. He started his career as a lawyer, but didn't get exposure to Real Estate until he joined Simpson Thacher & Bartlett LLP in the Real Estate Group where he primarily served clients like Blackstone and KKR. After realizing how difficult it was for individuals to purchase CRE properties, and with the passage of the Jobs Act, he decided to start EquityMultiple.

Having left his high-paying corporate job to start his own company, Charles is clearly a risk-taker, but after speaking with him it’s evident that he is a calculated risk taker. He saw an opportunity to make institutional-grade Real Estate investing accessible online after the passage of the Jobs Act. To merge the old, tried and tested frameworks of high-quality diligence with the new way of raising capital. To leverage technology to make it seamless. To truly create a great, high-quality product for investors. It was irresistible. The entrepreneurial itch was real.

Eight years later, EquityMultiple operates on similar values. With a solid investment team, EquityMultiple is able to help investors diversify their portfolio with Real Estate investments, which and earn high yields by taking calculated risks.

When asked what advice he would give his younger-self he talked about 2 things: (i) education around the breadth and depth of investments, and (ii) taking risks in a diversified way, again referring to taking those calculated risks, especially when you’re younger.

I could not agree with him more. Taking calculated risks means maximizing your potential return on investment while minimizing your risk. It’s typically achievable by:

Understanding your personal risk tolerance

Educating yourself about available investments, how they are valued, and how they might fluctuate based on external factors

Taking advantage of risk mitigating / reduction strategies, such as diversification

What you can expect In this interview

Charles' journey starting EquityMultiple

The Jobs Act and its role in opening up online investing

EquityMultiple’s platform (products, due diligence process, investor profile, advantages, approach to changes in the market, realized returns, fees and more)

Future outlook for EquityMultiple and the real estate market

Going from corporate to startup

Charles' investing tips he would give to his younger self

EquityMultiple Overview

Focus primarily on individual multifamily and industrial CRE properties

Middle-market deals (below $50M)

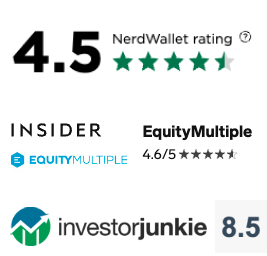

Types of Investments

Keep - For stable income

Earn - For short-term fixed returns with a focus on income

Grow - For higher potential returns through value-add properties

Minimum Investment: $5,000 to $25,000

Lock-Up Period: 3 months to 7 years

Deals: 84 exited (~180 total)

Returns: 17% average annual return

Users

40,000 total users (10% active)

On average, active investors invested 5 times

Average investment size: $25k

High-income earning professionals

Fees:

Upfront fee from transaction (e.g., loan origination fee, equity admin tech fee)

1% annual Asset Management fee

Share of sponsor's carried interest

Only open to accredited investors

Thanks for reading!

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.

Charles Clinton: Taking calculated risks