Date recorded: March 23, 2023

Listen on Itunes, Spotify, or watch on Youtube.

Hey friends 👋

I’m personally not a big fan of luxury goods. They promote materialism and a focus on superficial qualities over personal growth, relationships, and meaningful experiences. They cause divide in society through status or class. Worst of all, studies find that those who cannot afford luxury goods purchase them to “feel rich” instead of spending their money wisely elsewhere. I am not saying that I don’t appreciate the creativity and beauty of certain luxury items, I just think they can (and have) send the wrong message.

That being said, luxury assets can be good investments. A Hermes Birkin, for example, has had an average annual price appreciation of 14.2% over the past 35 years. Similarly, certain fine wines have exhibited promising historical returns. Certain luxury watches have also seen double digit returns.

Looking at luxury watches specifically, Rolex, Patek Philippe, and Audemars Piguet (“the big 3”) have performed well over the past 5 years. According to a new report by Boston Consulting Group (BCG), the “big three” returned 20% annually since August 2018, besting the S&P 500 over the same time period. The BCG report also pointed out that a collection of watches from independent brands like F.P. Journe, H. Moser & Cie, and De Bethune, returned 15% during that time.

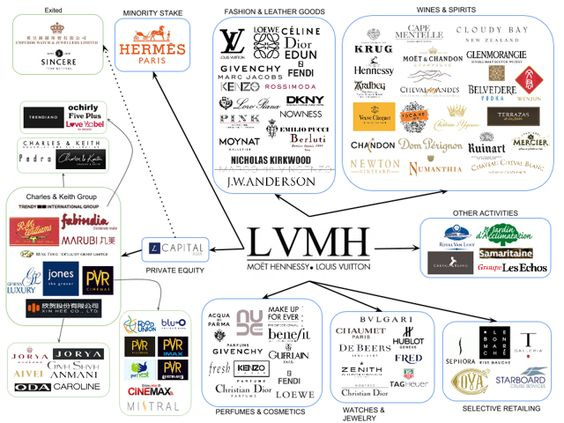

Luxury goods like these tend to hold their value even during recessions. In fact, they are considered recession-proof because their clientele are wealthy individuals who are not affected by a recession and instead see certain luxury goods as a store of value. That’s why LVMH, the largest company in Europe and a top 20 company in the world, is considered a recession-proof company. They sell low to high-end luxury brand products in five categories and over 60 major fashion brands known as houses. These categories include wines and spirits (26 houses), fashion and leather goods (14 houses), watches and jewelry (8 houses), perfumes and cosmetics (15 houses), and selective retailing (5 houses) including Sephora, DFS, and Starboard Cruise Services.

However, not all watches (and luxury goods) are made equal. All do not appreciate in value. In fact, 99% of luxury items are not good investments. So what should we invest in? Figuring that out will take time and effort, and acquiring these assets might be even more difficult. You might have to find an expert, you might have to participate in auctions and so on. That’s where platforms like Konvi come in to play.

In this episode I interview Ioana Surdu-Bob, co-founder & CEO of Konvi, a marketplace that allows anyone in the European Union to invest in exotic assets. They started with luxury watches, but now also provide access to fine wines, rare whiskeys, luxury handbags, and exotic cars. Ioana was always diligent with her money. She started saving early, which allowed her to purchase her first apartment at the age of 22. After accomplishing this goal she started investing her money into other assets. With a background in computer science and a new found interest in collectibles, she and her co-founder decided to start Konvi.

Realizing the investment potential of certain luxury assets that have consistently outperformed other asset classes in the past years, the question arose: Why are these investment classes not accessible to the broader population? With such high prices only the wealthy can source and access them. Konvi connects with industry experts and luxury funds around the world to make these highly lucrative and exclusive assets accessible to everyone through their platform.

In this episode I interview Ioana about:

Her journey starting Konvi

Benefits of investing in exotic assets

How Konvi provides access to these investments

A breakdown of historical returns of asset classes on Konvi

Ioana's advice for new investors

Everything you need to know about Konvi

Konvi’s goal is to break down the barriers to alternative assets that have previously only been accessible to wealthy investors. They allows you to partially own rare, high-end luxury items that would normally not be accessible to you because of the high capital requirements, and the lack of accessibility.

Konvi conducts research to identify and source luxury items with the best potential returns on your behalf by working with experts and partners. These assets are then securitized and turned into equity shares to enable partial investment by individuals at as little as €250. Investors can use Konvi to create custom diversified portfolios by holding stakes in a variety of asset types.

By investing through Konvi you get to take advantage of the 4 potential benefits of investing in alternative assets:

Appreciation: A potential increase in the price of the asset.

Diversification: Access to assets that have a low correlation to traditional investments, hence serving as a great way to diversify your portfolio.

Inflation protection: Alternatives increase the long-term, risk-adjusted earnings of your portfolio. They provide a greater opportunity to outperform price rises and increase your purchasing power.

Access: To take part in the ownership of the rarest and most sought-after assets in the world.

To invest you have to reserve shares to get priority access to an investment. Once the crowdfunding campaign (IAO) opens, you can purchase shares directly via direct bank transfer (SEPA) or credit card. As soon as the IAO is funded, you will become a shareholder in a holding company (Special Purpose Vehicle) that owns, manages, and sells the asset. The percentage of your holdings in the company will be reflected by the size of your order. The partner then acquires the asset, which is authenticated by an external party. The asset will then be legally owned by all shareholders and will be safely stored and insured with our partners.

At the end of the pre-specified appreciation period, Konvi’s partners sell the assets within 6 months to their network of buyers and collectors. An asset can also be sold before the appreciation period ends if the sale offer is higher than the predefined target value increase. All net returns are proportionally paid back to all legal shareholders of the holding company.

From 60/40 to 40/30/30

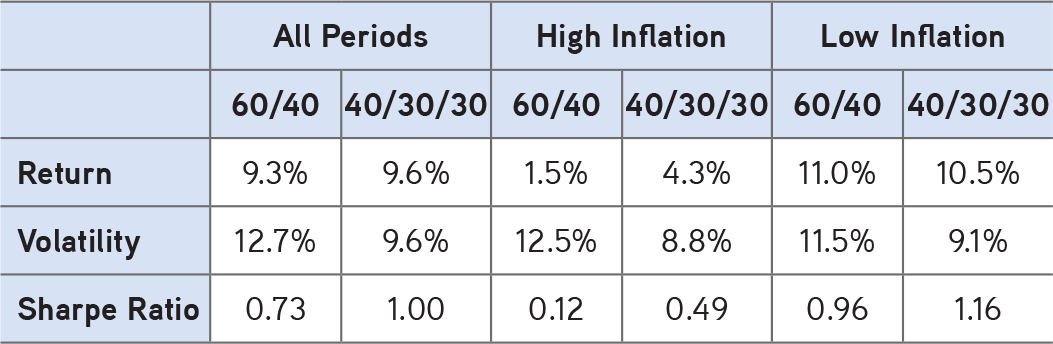

During out conversation Ioana talked about portfolio composition, a topic I personally enjoy diving into. She brought up KKR’s recent publication on shifting the traditional 60/40 portfolio split (i.e., 60% stocks and 40% bonds) to a 40/30/30 portfolio split (40% stock, 30% bonds and 30% alternative assets).

The publication centers around the theme that the traditional relationship between stocks and bonds has changed. In particular, KKR believes that not only are future returns likely to be lower, but also that bonds can no longer serve as shock absorbers or diversifiers when paired with equities.

Given this view, KKR believes that investors should consider adding alternative investments to their ‘60/40’ mix to protect their purchasing power in the new economic / investing environment. Specifically, they think adding asset classes, such as Private Real Estate and Private Infrastructure can enhance the Equity part of the ‘60’ portfolio, while Private Credit can bolster the ‘40’ segment of the Fixed Income portfolio. Additionally, they believe that the increasing democratization of alternative asset classes is creating a compelling opportunity for all investors to harness the illiquidity premium in a potentially more thoughtful way.

To illustrate, KKR ran a traditional ‘60/40’ portfolio against the suggested ‘40/30/30’ portfolio in three differing scenarios: low inflation, high inflation, and all periods (regardless of inflation). They substituted 20% of the Public Equities sleeve with a combination of 10% Private Real Estate and 10% Private Infrastructure, and replaced 10% of the traditional Bond allocation with 10% of Private Credit (Note that the observation period for private asset classes is shorter than for public stocks and bonds).

The private alternatives enhanced ‘40/30/30’ portfolio significantly reduced portfolio volatility while maintaining or improving returns in all environments. In low inflation environments, volatility is reduced by 2.5% and returns reduced by a mere 50 basis points, significantly increasing the expected Sharpe ratio. More importantly, in high inflation environments, volatility in the ‘40/30/30’ portfolio was reduced by 3.7% while returns were enhanced by 2.8%, improving the Sharpe ratio by almost 0.4x.

Ioana points out that high net worth individuals now allocate ~5% or more to exotic assets outside of their private equity and real estate investments. The alternative investment pool keeps growing.

Thanks for reading! I hope you found the interview and the newsletter insightful.

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.

Share this post