Date recorded: March 14, 2023

Listen on Itunes, Spotify, or watch on Youtube.

Hey friends 👋

Have you ever seen a $150,000 bottle of wine? Or an $80,000 bottle of whiskey? Until recently, I was not aware that wines and spirits could have such high price tags. Welcome to the world of fine wines 🍷 & rare spirits 🥃, a.k.a. liquid gold.

As a society we certainly have a love for alcoholic beverages. Revenue in the alcoholic drinks market in the United States alone is ~$284 billion. Outside of our consumption habits, however, wine is a beverage that has had historical and cultural significance. We’ve used it in religious ceremonies, as a symbol of luxury / sophistication, for celebrations, in cooking, as artistic inspiration, and so much more. We value it dearly.

Fine wine, though, is somewhat of a mystery to most. Even wine lovers have probably not been exposed to the seemingly ridiculous world of fine wines. Why can a bottle of fine wine command a price more than an average home? Who is buying these wines? How good can they actually be?

Fine wines are typically not purchased for consumption. They hold value due to their historical significance, brand power, and the limited supply of these bottles. Only the top 0.1% to 1% have historically had the capital to purchase fine wine. It’s a rich person’s hobby. A collector’s item. A dinner conversation starter. A rare commodity.

Outside of the price, it’s quite difficult to obtain and store fine wine. The market is opaque and entry to it is controlled by brokers. You typically have to work with brokers out of the UK who manage the exchange of fine wine. Additionally, unless you have your own temperature and humidity controlled wine cellar, you would have to use existing storage units.

Finally, even if you manage to source and store fine wine, how do you know which ones are valuable? Data on financial performance of fine wine is scarce. There are multiple factors that go into determining the value of fine wine, including critic scores, prices, supply, regions, brand power, and a fundamental understanding of the market. You can probably see why fine wine has been such a niche market.

Sounds like a ton of hassle for someone who does not have the time, resources or even the interest to track the fine wine sector. Things, however, are changing. With changes in technology and regulations the fine wine industry is opening up to people outside of collectors, enthusiasts and the ultra-rich. A number of platforms have come up over the past decade with that very goal. With easier access, investors are looking at the fine wine and spirits asset class more closely as a way to diversify their portfolios. The asset class is becoming investible.

In this episode I interview Nick King, co-founder & CEO of Vint, a platform that is securitizing fine wine and rare spirits allowing investors to efficiently get exposure to the asset class.

With a background in value investing, Nick was looking for uncorrelated assets to diversify his portfolio when he stumbled on the fine wine & spirits asset class. After some research, Nick and his co-founder, Patrick Sanders, found that fine wine had a very low correlation to public markets. They ran a small portfolio generating ~30% returns in a short period of time. The combination of low correlation to public markets and attractive returns, fine wine looked like a good candidate to diversify any portfolio.

However, they ran into difficulties trying to scale.

“Basically, you needed to cut a $25,000 check to someone in the UK, and you would get a list of wines back 3 weeks later. Really inefficient, opaque, largely inaccessible, and frankly just not a financial product,” Nick recalled.

Seeing an opportunity in the space they decided to start Vint.co.

In this episode I interview Nick about:

His journey starting Vint

Benefits of investing in the fine wine & spirits asset class

How Vint provides access to fine wine & spirits

Overview of Vint's platform and process

Outlook on the wine industry

Nick's advice for new investors

Fine wine & spirits as an investment

As Nick and Patrick discovered, fine wine and spirits are an attractive investment. However, it isn’t easily accessible and is a pretty opaque industry. Here are some of the characteristics of fine wine that stand out as an investment.

1. High annualized historical returns

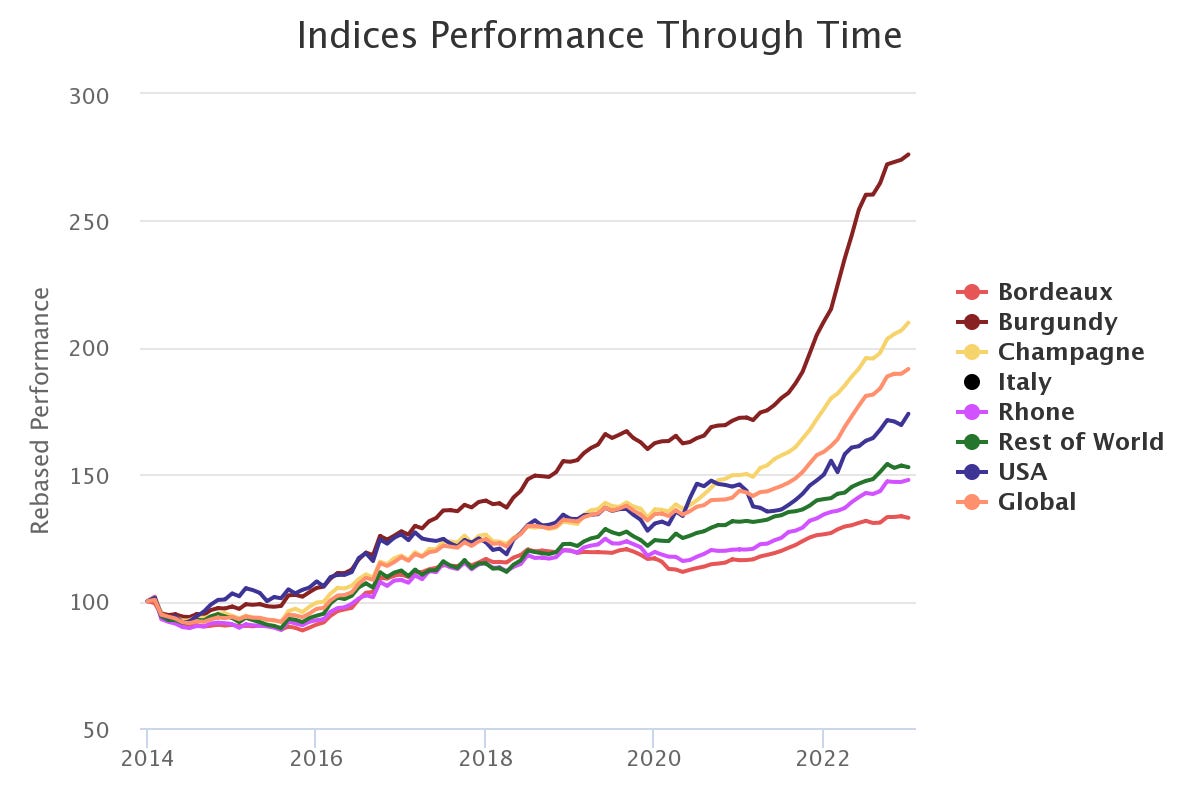

Just like the S&P 500 is the benchmark index for U.S. stock performance, the London International Vintners Exchange (Liv-ex) is the benchmark for the fine wine market. Since 2000, the Liv-ex indices have been tracking the prices of the world’s most traded fine wines.

The Liv-ex Fine Wine 1000 index, for example, tracks 1,000 wines from across the world using the Liv-ex Mid Price, calculated monthly.. Over the last 5 years it has returned ~45.81%.

Over a 30 year period fine wine has returned 10.6% annualized, and according to Vint, over 121 years fine wine has returned 8.5% annually.

2. Low correlation to public markets, like the stock market

Diversification is key to building a strong, resistant portfolio. Fine wine has been shown to have very little correlation to the overall global stock market. During the 2008 financial crisis, for example, when the housing crisis rocked markets, the S&P dropped 38% while the Liv-Ex 1000 fell less than 1%. Similarly, in 2022 when the stock, bond and crypto markets fell in unison, fine wine gained 20.54%.

With extremely high price tags, only the top 0.01% to 1% of the population has traditionally had access to the fine wine asset class. With that clientele, fine wine and spirits are able to weather recessions similar to other luxury good companies. LVMH, the largest company in Europe and a top 20 company in the world, is one such luxury goods company that is a poster child for why luxury goods are recession resilient.

3. Highly economically inefficient

The industry is very opaque and information asymmetry is rampant. This provides an opportunity to source assets below their intrinsic value, something that caught Nick’s eye as a value investor.

However, not all fine wines are made equal

Burgundy and Champagne have led the pack over the past 7 years, and in 2022 gained 31.31% and 19.35%, respectively. Blindly purchasing any fine wine isn’t going to give you the returns or diversification you desire.

How Vint gives you efficient access to fine wines & spirits

Fine wine and spirits sound like good investments. So how can we get access? The short answer is it hasn’t been easy until platforms like Vint have opened up access. The price tag is not the only barrier. As Nick pointed out, it is a very opaque industry with limited supply and a ton of inefficiencies across the entire lifecycle of sourcing, storing and selling collections. The only people who have historically gone through the trouble of buying these rare assets are the top 1% or wine enthusiasts… collectors.

Vint is solving this problem by (i) taking care of the complications that come with sourcing, storing and selling for their customers, and (ii) enabling fractional ownership of collections. On the Vint platform you can get access to rare fine wine and spirit collections ranging from $25,000 to $500,000 at as little as $50 to $100. A collection can be a single bottle, 1,000 bottles or anything in between. Investments are open to both accredited and non-accredited investors. You can be invested within 3 minutes of signing up.

However, Vint’s true value-add is not the fact that they have opened up access to the asset class, it’s what they give access to - the specific assets they source.

Vint’s fundamental focus is to financializing the fine wine & spirits asset class. What does that mean? In a nutshell, Vint works with the SEC to securitize their fine wine & spirit collections under Regulation A+ of the JOBS Act. By complying with the Reg A+ requirement of providing full transparency on the risks and returns associated with the underlying asset, Vint enables anyone to be a fractional owner of a collection.

Nick views this an edge over competitors who aren’t working with regulators. The idea is to help investors evaluate fine wine and spirit as financial securities, thereby shifting the focus to returns, volatility and correlation of the underlying assets, as opposed to a consumable good or a collectible. Working with the SEC enables Vint to be fully transparent with their customers.

Financializing the asset class, Vint is not putting just any fine wine or spirit they find on their platform. They aim to provide their investors with efficient diversification by looking for the best, highest-quality assets that have the highest potential for return. They do this by combining fundamental, expert-driven analysis with data-driven analysis:

Fundamental analysis: They have an in-house expert that gives them a good understanding of the market. Identifying regions, vintages that are quality from a fundamental perspective is one of the key factors that they use to source.

Data analysis: The wine and spirits industry is notoriously outdated with little available data. Vint is consolidating data from the UK market, US market and auction markets to identify assets that may be mis-priced or undervalued. They look at pricing data, scoring data, brand power, and supply data to get a holistic view.

Here’s how Vint’s platform works:

Sourcing: Focus on sourcing high-quality assets using expert-driven fundamental analysis and data.

Securitize the asset: Once sourced, Vint files paperwork with the SEC to securitize the collection, providing full transparency to their customers.

Release collection on platform: Once the collection is securitized, Vint will release the collection on their platform for investors to buy shares.

Manage storage and insurance: On the back end, Vint manages storage and insurance. They store collection in facilities specifically designed to store fine wine and spirits. The facilities are temperature controlled, humidity controlled, and perform provenance checks and quality checks. Vint also insures the assets over the entire lifecycle of the collection.

Exit collection: Over that hold period Vint follows trends to identify a good time to exit the assets. They exit through a number of channels. They have licenses to exit in the US and also have partners in the UK, Europe and Hong Kong.

Return proceeds: Once a collection is exited, Vint returns the proceeds to investors on a pro-rata basis, completing the lifecycle of a collection.

All this, of course, comes at a price. Vint charges a 5% - 20% upfront sourcing fee for access and pricing that they are able to provide, noting:

They have lower sourcing costs as they source from B2B channels

They have lower storage costs as they operate at scale

They charge low transaction fees when exiting, compared to an auction house, for example, that could charge 30%

How I would use Vint

Personally, I view Vint’s collections to be a great way to diversify your portfolio. I’m bullish on the product. Having access to an asset class that has historically been a collectors item is unique. As I’ve already pointed out, these assets function differently from traditional markets (uncorrelated) and are relatively less volatile. As regulations change and technology evolves this trend of making traditionally inaccessible assets investible (“financializing”) is only going to continue.

Looking at wine & spirits specifically, its a win-win for both investors and wine/spirit enthusiasts alike. You don’t have to be passionate about wine or spirits to reap the financial benefits of the asset class, and you don’t have to be an investor to enjoy the fact that you have ownership in an extremely rare wine or spirit.

That being said, I wouldn’t advise anyone to blindly invest in anything without having an understanding of the market and the key drivers. That’s why I wrote this post, but unfortunately, the best way to learn is by doing. Luckily, you can start investing on Vint with as little as $50-$100. As a newbie, I would place a small investment into their collections and use that as a reason to track it closely, as a result, learning about the market. I’ve typically found this to be an effective strategy when diving into a new asset class. The fear of losing money is enough incentive to quickly learn about the market.

Thanks for reading! I hope you found the interview and the newsletter insightful.

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.