Date recorded: May 5, 2023

Listen on Itunes, Spotify, or watch on Youtube.

Hey friends 👋

Did you know banks aren’t the only place you (or companies) can get loans? There’s a new kid on the block in the alternative investments space that has been getting a ton of buzz lately - private credit. Ok, ok, not exactly new. Private credit has been around for a long time. We as consumers have experienced it in various shapes and forms - P2P lending, buy now pay later (BNPL), earned wage access and so on.

Private credit has recently come into the limelight after bank lending tightened over the last few years. As investment banks and traditional debt investors pulled back from leveraged debt amid fears of rising interest rates and an economic slowdown, demand for private credit has been on the rise. Silicon Valley Bank’s failure and Credit Suisse Group AG’s shakeup has accelerated that trend. Investors seeking higher yields have been pouring money into the asset class, turning private credit into a thriving market.

KKR also highlighted the benefit of adding exposure to private credit in their December 2022 paper, “Regime Change: The Benefits of Private Credit in the ‘Traditional’ Portfolio,” They argue that replacing 10% of the 40% allocated to bonds with private credit in the traditional 60/40 portfolio split can boost returns, reduce durations and provide diversification.

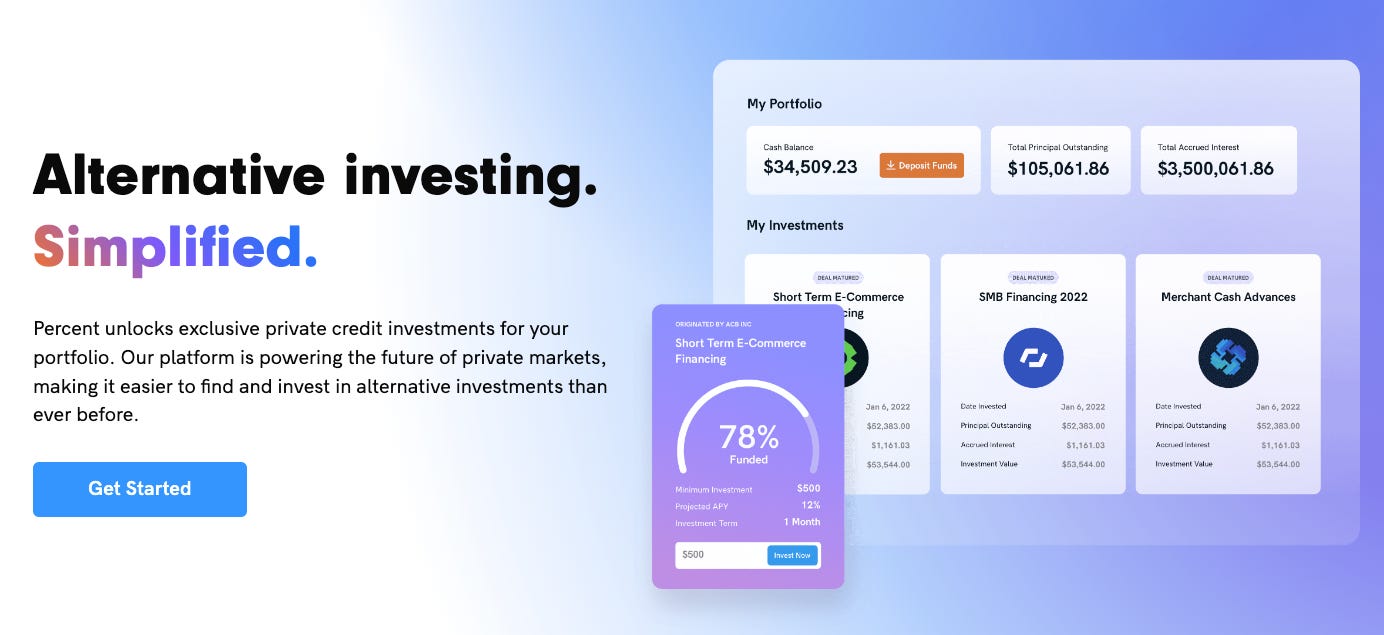

In this episode I interview Nelson Chu, Founder & CEO of Percent, a platform that started off providing accredited investors access to private credit investments, and has since evolved into the modern credit marketplace. Percent’s SaaS solution powers the sourcing, structuring, syndication, surveillance and servicing of private credit transactions. At a high level, Percent allows investors to find and compare private credit deals, which promise both high returns and resilience to recessions and inflation.

Nelson started his career in finance at Merrill Lynch (acquired by Bank of America) and then moved to the buy-side at BlackRock, where he worked in fixed income portfolio management operations. With an entrepreneurial itch, Nelson quit his job and started a consulting company helping founders build companies from ground up. After helping a number of founders for 5+ years, Nelson decided to start Percent, an alternative investment platform focusing on private credit.

Here’s what you can expect in today’s episode:

Nelson’s journey starting Percent

An introduction to private credit

The risks associated with private credit investing

Why private credit has been in the limelight recently

How Percent has leveraged technology to provide investors with transparency

How Percent has evolved from a platform focusing on private credit investing to a credit marketplace

Nelson's unique investment and asset allocation strategy

So what exactly is private credit?

Private credit refers to debt financing provided by non-bank entities to individuals or companies. It essentially is an alternative to traditional bank lending financed by private investors. They include small business & consumer loans, venture debt, and other forms of private debt. These entities seek private credit when they cannot access public credit markets. It’s the debt counterpart to private equity.

Private debt funds have been around for a long time, but the industry really evolved after the 2008 financial crisis when bank lending tightened. With new regulations in place (namely the Dodd-Frank Act), banks had to hold more capital against riskier assets on their balance sheet making it more costly for them to lend to private, relatively riskier companies that needed long-term debt funding.

This opened up opportunities for private debt funds to directly lend to companies. Funds expanded their strategies to include special situations/distressed debt, venture (early stage) debt, real estate debt/mortgages, infrastructure debt, and asset-backed debt of more esoteric assets like trade receivables.

However, these investments were limited to institutional investors until the passage of the JOBS Act, which made it easier for companies to raise funds via crowdfunding. After the passage of the JOBS Act a number of peer-to-peer lending companies, like Lending Club, Funding Circle, Upstart and Percent emerged. These platforms connected smaller borrowers looking for debt financing with both retail and institutional investors seeking short-term, high-yielding assets.

Private credit helped fill the lending gap that smaller companies, which might have either tapped out their bank financing or are not qualified for bank-based credit, faced. It provides early-stage companies with another non-dilutive option to traditional bank financing while providing access to retail and institutional investors (and vice-versa).

Risk & Return

Private credit can provide attractive risk-adjusted returns for investors seeking higher yields than those offered by traditional fixed-income securities. By investing in private credit, institutional and retail investors can diversify their portfolios and potentially generate consistent income streams.

Private credit transactions are typically negotiated directly between the borrower and the lender, allowing for customization of loan terms and covenants. This flexibility can be particularly beneficial for borrowers who may have unique financing needs or face challenges accessing traditional bank loans.

However, it's important to note that private credit investments are generally considered riskier than public market investments. They often involve higher interest rates, less liquidity, and a higher potential for default or loss of principal. Investors in private credit must carefully evaluate the creditworthiness of borrowers, assess the underlying assets or cash flows supporting the loans, and understand the specific terms and risks associated with each investment.

Private credit & the recent bank crisis

In March, when Silicon Valley Bank (SVB) failed, private credit became the go-to source for short-term capital for startups that were banking with SVB, but didn’t have access to their capital. Nelson recounted in our interview:

We were not attractive as an asset class. But then when the market turned, we became the hottest deal on the street… and it all culminated in that weekend when SVB went under.

In that weekend we had several hundred startups reach out to us and our partners saying, “I need bridge financing. I'm not gonna make it. Next payroll cycle is on Monday!”

We had underwriters who were ready to go because they've worked with us before, they know our structure, they know our technology, they know how to use it. And we had investors / lenders who said, “I wanna support the ecosystem. This is like a risk-free trade for a week. Cuz the Fed's not gonna let this thing go under. Guaranteed.”

So by Sunday afternoon before the Treasury Department made their announcement, we had like 25 startups give or take with $50 million in capital ready to go by Monday morning, like in a 36 hour timeframe of figuring this out.

That weekend I think every VC learned what private credit was.

Why did Nelson start Percent?

After helping a number of FinTech startups, Nelson was inclined to start a company in the space. He was particularly interested in the alternative investments space as it was a rapidly growing segment. There were a lot of platforms popping up, but none were very investor friendly:

The lock up periods were typically long (4 to 5 years)

The minimums were pretty high ($25k to $30k)

The yields were either highly unpredictable or around 9% to 16%.

Nelson wanted to provide access to investments that:

Are investor friendly

Are shorter duration (one, two or three months)

Have a lower minimum (e.g., ~$500)

Clear the 9% to 16% hurdle that everyone else was providing

Private credit fit the bill.

Everything you need to know about Percent

Percent has evolved from a platform providing accredited investors access to private credit investments to the infrastructure powering the sourcing, structuring, syndication, surveillance and servicing of private credit transactions. They sit at the intersection of investors, borrowers and underwriters, and focus on providing full transparency to the end investor.

The technology has come a long way from 2009. You have a lot of layer one infrastructure being built that has been really helpful in trying to understand exactly what is going on in an underlying portfolio. Back in the day, you had Excel files being shot back and forth saying, 'This is what this consumer is doing. This is how much they're paying.'

Percent prides itself on the technology they use to ensure transparency. They are close to replicating public market efficiencies in the private credit market. They aim to create the market standard for private credit by capturing real-time information on, for example, delinquencies, which wasn’t being done a decade ago. They do weekly surveillance reporting on every single borrower they have in their ecosystem and all the assets that comprise their portfolio.

Percent started with asset-backed securities. They created standardized templates to be able to facilitate these transactions and created standardized reporting to be able to monitor performance. They then used that to scale to any asset class within private credit. They added corporate debt in 2022.

Though their primary target was retail investors, recently they have seen an increased interest from family office and credit funds. CNBC also recently reported on this broader uptick in interest from family offices in private credit stating, “One of the hottest growth areas for family offices is private credit, with regional banks pulling back on their lending.”

Conclusion

In a nutshell, if you are interested in private credit, definitely check out Percent. Private credit can be a great way to diversify your portfolio and Percent has really made it easy to access it with lower minimums, shorter durations and full transparency on the quality of each deal on their platform. They also enable investors to easily compare deals.

That being said, private credit is definitely not for the faint hearted. You can earn higher interest rates because of the relatively higher risk you take on by investing in this asset class. So private credit typically attracts investors with higher risk tolerance. The percentage of your portfolio that is allocated to this asset class should be carefully determined, and you should perform your own due diligence.

Thanks for reading! I hope you enjoyed the interview and the read.

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.