Date recorded: April 8, 2023

Listen on Itunes, Spotify, or watch on Youtube.

Hey friends 👋

After 3 weeks of evaluating real estate crowdfunding platforms, I need a change of pace and I’m sure you do too. Real Estate is a great asset class, but outside of the numbers, it’s far from sexy. (can’t believe I just implied numbers are sexy 🤦🏻♂️… moving on)

Today we’ll instead focus on the exciting (and risky) world of startup investing. Startups just hit different. They bring about feelings of opportunity, endless possibilities, astronomical growth, pursuit, passion, camaraderie, building something new out of nothing, and so much more. Startups have changed the world as we know it. It’s electrifying.

At the surface, startup investing is extremely attractive because of the insane returns that can be earned. There is almost no other asset class that can give you the kind of returns that some startups have been able to provide investors. However, with great potentials for returns come great risks - there is also almost no other asset class that is as risky as investing in a startup.

In today’s episode, I interview Kendrick Nguyen, CEO of Republic. Kendrick has had a whirlwind of a career starting in law, working at a hedge fund, moving into academia at Stanford Law, and then finally settling into Tech. Serving as General Counsel at AngelList, Kendrick was heavily involved in the development of the the platform’s syndicate and fund management products, which is now a staple for startup fundraising in Silicon Valley. When it comes to startup investing, he’s a great person to talk to given his experience spans not only investing in startups, but also in:

Building the infrastructure to allow accredited investors and fund managers to easily invest in startups at AngelList, and

Then taking it a step further by providing non-accredited investors access to startup investing at Republic

Before we dive into the biggest takeaway from my discussion with Ken: the importance of iteration, it is important to understand:

What investing in startups is all about, and

How Kendrick’s former company, AngelList, was instrumental in shaping the laws that opened up startup investing, and all private investing, through the passage of the JOBS Act

Startup investing

Ever wanted to invest early in companies like Google, Facebook, Amazon, Apple or any of the startups that ended up as the multi-billion dollar unicorns 🦄 we know today? Me too. I’ve often run the math on the returns on these investments. They leave my eyes popping 😳.

Let’s look at Facebook for a real-world example:

In 2004, the social network received its first investment of $500,000 from Peter Thiel for 10% ownership at a $5M valuation 💵.

On May 18, 2012, Facebook went public at a $104B valuation. Thiel’s shares diluted significantly since his initial investment, but the valuation of the company at IPO was 28,000x it’s initial valuation 🤯.

Thiel sold majority (~$1B worth) of shares in 2012 followed by a few small sales making a total of $1.16B by the end of 2017 off his Facebook investment, a 2,300x return 💰.

He invested in Facebook when it was still a private, pre-growth company, and sold his shares when the company went public. Wouldn’t it be great for the average individual to also be able to invest early in startups, getting exposure to the seemingly astronomical upside? In an ideal world, absolutely! However, there are a number of very good reasons why the average individual has historically not been able to access to early stage investing:

Startups and VCs have been a close-knit community hard to get access to for the average investor: Peter Thiel had already been part of the startup and Venture Capital ecosystem since his PayPal days. Being a successful entrepreneur himself, Mark Zuckerberg went to him to raise funds. Money is not the only obstacle in startup investing, you also need to know the right people and be part of the community. Founders are often looking for investors that are able to bring something to the table outside of just the $$, like network, expertise, synergies, etc.

Startup investing is very very risky: Statistically, 90% of startups fail. That means if you invest in a wide enough pool of startups, the money invested in 90% of them will go to $0. Now let’s say you instead were like Peter Thiel and you only invested in one startup with the same conviction that Peter had in Facebook, but the company actually failed. That $500,000 check you wrote would be $0 today.

Because startups are so risky, they are open only to accredited investors: Startup investing is a case of private investing where I agree with having a delineation between accredited and non-accredited investors. To be able to invest in startups you have to be cool with losing a large amount of money. Let’s face it, how likely are you to pick or get access to the next Facebook? You have to have a high risk tolerance and a high pain (loss) threshold, such that losing the money invested doesn’t make any difference to your life.

Investing through Venture Capital firms reduces that risk, but its hard to get access to them: The business model of Venture Capital firms is to invest in, for example, 100 early-to-mid stage startups, and hope that 1 to 3 of them do so gosh darn well that the outsized returns from those investments justify the failure of majority of the portfolio. They rely on due diligence, experience, network and diversification to pick better deals than you and I can. Because, in aggregate, they are deploying large sums of capital, and the level of risk is still pretty high, they rely on institutional and high-net worth individuals for funding.

How Republic started

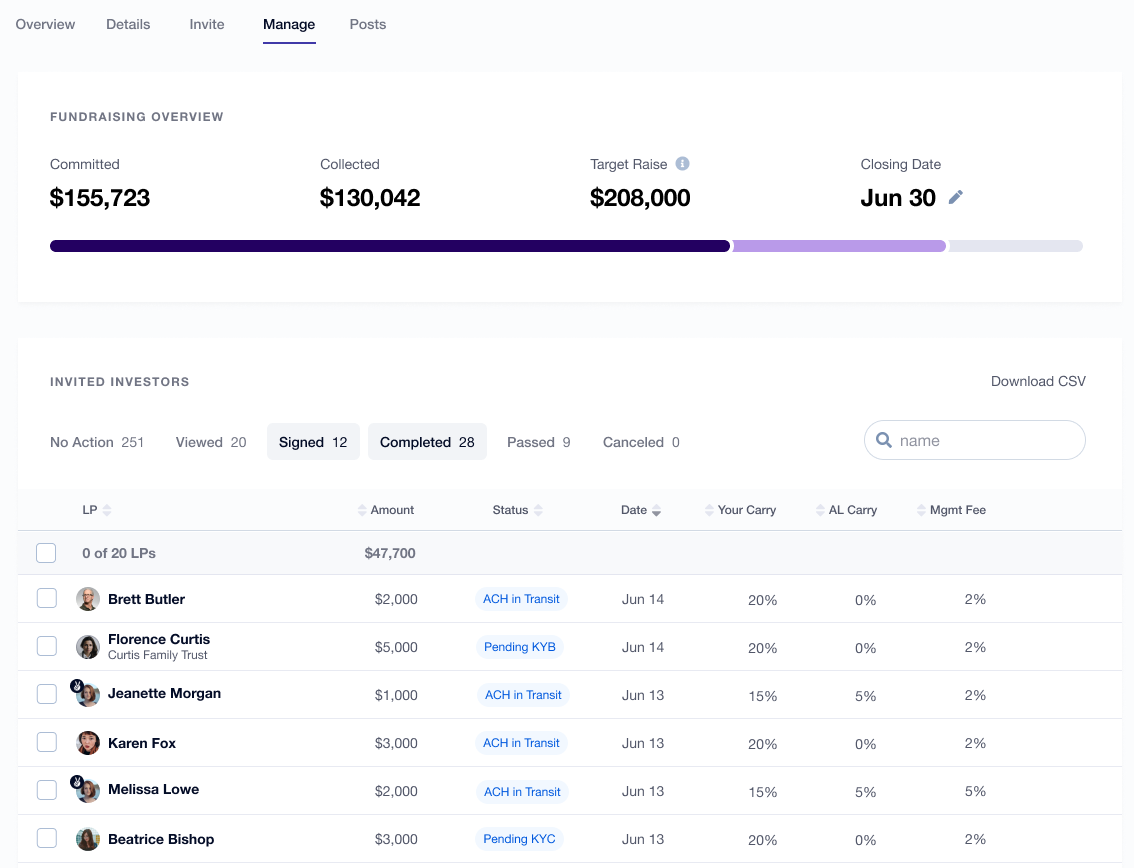

Needless to say, it was still difficult for startups to raise funding, for VCs to deploy capital, and for accredited investors to get access to the startup ecosystem. That was until AngelList, the company founded by Naval Ravikant, developed the technical infrastructure to solve this exact problem. AngelList’s investment product, now AngelList Ventures, allows:

Fund Managers to raise money through the platform without having to worry about the legal and operational hassles that come with starting a fund.

Founders to raise capital from funds and accredited investors.

Accredited investors to deploy capital into individual startups of funds.

Today, all of this can be done online with a few clicks on the AngelList Ventures platform.

Though a major technical feat, the technology would not have been as useful without the passage of the JOBS Act, which permitted “general solicitation,” allowing startups to openly advertise funding rounds as long as they took "reasonable steps" to ensure investors were accredited. AngelList, in fact, actively lobbied for the passage of the JOBS Act. With its passage AngelList was able to launch its Syndicates product, which allowed investors to negotiate an allocation into a startup, then accept co-investors to join them.

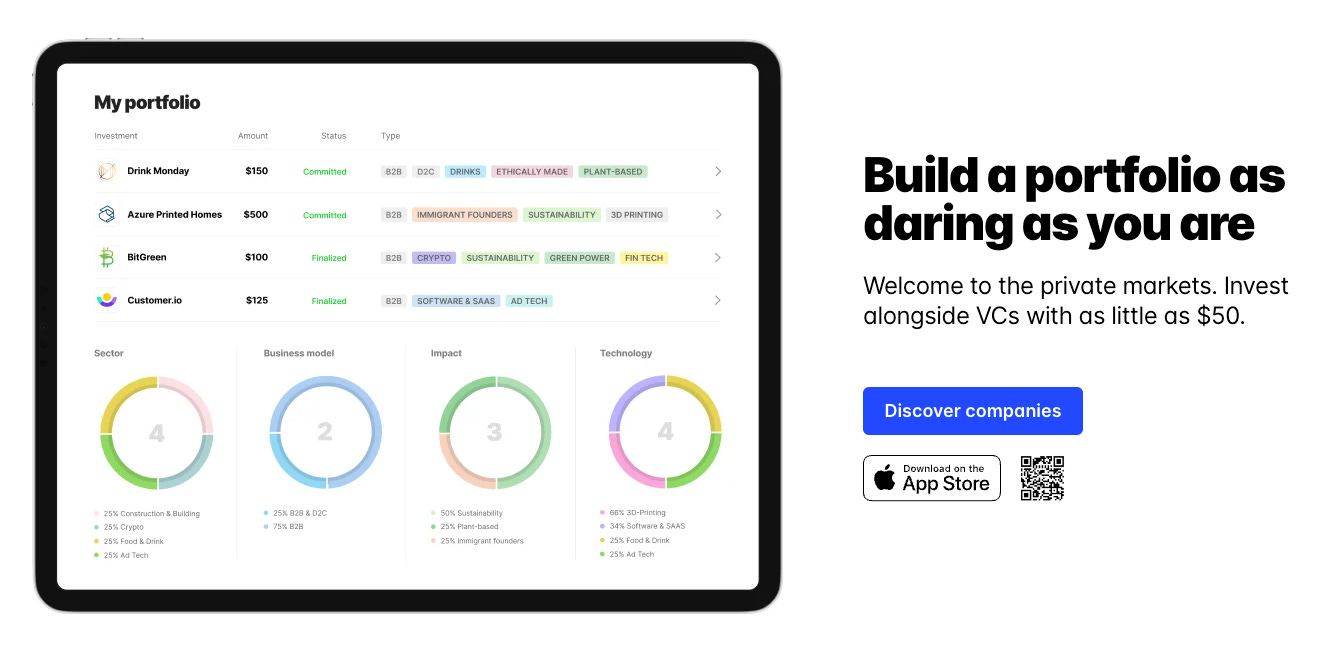

Title III of the JOBS Act, which kicked-in May 16, 2016, also allowed private companies to access investments from non-accredited investors. Though AngelList solved this problem for accredited investors, its product was unable to service the non-accredited investor population because of the legal complexities involved. Kendrick Nguyen, then General Counsel at AngelList, saw this limitation as an opportunity. He understood that with the right operations and legal team, he could open up startup investing to non-accredited investors. And thus, in 2016, Republic was born.

Kendrick took AngelList’s vision one - seemingly small, but in reality astronomical - step further, making startup investing accessible to non-accredited investors.

Iteration

Kendrick’s vision aligns with my goal for this newsletter. While I am on the journey of demystifying private investing, Kendrick is actively democratizing private investing through Republic. I had to find a way to get Ken on the show.

I had the privilege of being introduced to him by Ankur Nagpal in 2021. Just a few minutes into our conversation it was clear that he was different from other founders I had met (so far). He’s got all the traits of a great founder - passionate, driven with a get-shit-done attitude. What stood out about him, however, was that even while building Republic into the behemoth of a company it is today, he was humble and exuded positivity. While everyone else was seemingly bragging about their metrics, Kendrick preferred to listen and be present in every conversation no matter who you were. He’s not just a great founder, but also an all-round great guy. You’ll notice those traits as you watch the interview.

This was the first time I had the chance to pick his brain about his journey, Republic and the recent events in the tech and crypto industry. As we discussed these topics, we constantly circled back to a common underlying theme that seems to be at the core of Kendrick’s beliefs: Iteration.

If you’ve been in the startup world you’re probably familiar with the concept. Experimentation and iteration tend to be at the core of building a company from scratch. Books like The Lean Startup by Eric Reis preach it like gospel. In the book Eric describes “The Lean Startup” methodology, which favors experimentation over elaborate planning, customer feedback over intuition, and iterative design over traditional “big design up front” development. The book also introduced the concepts of “minimum viable product” (MVP) and “pivoting” that we are so familiar with today.

There is no debate that constant experimentation and iteration are key to finding success as a startup. You have to be nimble - able to test ideas rapidly with customer feedback, iterate fast to build a product that customers want, and eventually strike that founder gold of Product-Market Fit (PMF).

AngelList, for example, ran numerous experiments before they found success. Today they are known for their core products: AngelList Ventures and AngelList Talent, but in the early days they experimented with a number of ideas. Throughout 2012, AngelList experimented with a tool to create standardized pitch decks, a platform for accelerators to manage applications, standardized legal documentation for fundraises (AngelList Docs), a recruiting portal (AngelList Talent), and a way for accredited investors to participate in startup financing (AngelList Invest).

It’s no surprise then, that as General Counsel at AngelList, Kendrick is also razor focused on iteration. Though Republic started by democratizing access to curated investments in startups, they have since expanded into multiple asset classes, such as crypto, real estate, art, music, and more. There is no doubt in my mind that iteration and experimentation were at the core of the decision making process to expand into these asset classes.

What was interesting about my conversation with Kendrick was that he applied the concept of iteration to his own life. To him change is good and iteration is necessary whether you want to build a company or a happy, meaningful life. It’s all built on the same principle.

He started out as a lawyer, worked at a hedge fund, took a 90% pay-cut during his time in academia at Stanford Law, moved to working at AngelList, and then started Republic. Though AngelList was fulfilling, he didn't think it was ultimately something he could pursue meaningfully for 50 years. His last iteration, Republic, has lasted for 7 years, and he feels like he is fulfilled enough that he can continue working on it for another 70 years.

I personally resonate with Kendrick’s application of iteration to personal life. You can have all the money in the world, but if you don’t have a sense of fulfillment through how you spend your time, you’re going to eventually look like one of the long-faced millionaires we see on the subway in New York everyday. And if you haven’t already struck that fulfillment, the only way to find it is to make changes in your life, to iterate, to find what makes you want to get out of bed every morning. Like Einstein said,

“Insanity is doing the same thing over and over and expecting different results.”

Thanks for reading! I hope you enjoyed the interview and the read.

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.

Share this post