Date recorded: March 10, 2023

Listen on Itunes, Spotify, or watch on Youtube.

Hey friends 👋

Another week, another episode. Just three months ago starting a podcast was far from anything I planned on dedicating time to, yet here we are - podcast #3 of what I envision will turn into hundreds.

At first I thought podcasting would be daunting, and it was, but as I’ve found my stride its getting to the point of being more energizing every week. Exploring alternative investments and the platforms providing access to them has got me turnt. Speaking to founders and experts in the space fulfills my curiosity, thirst for knowledge and need for intellectual, engaging conversation. I like getting into the minds of founders to understand their drive, and at the same time understand how they bring value to their customers. And doing so publicly - for anyone with the slightest curiosity to benefit - is the reward.

If you find these episodes informative, educational or entertaining, I urge you to ❤️, leave a comment, or share! Better yet, reply to this or message me on twitter! I’ll be thrilled to hear from you and excited to engage. Your feedback and insights are invaluable to me. 🙏

Today’s episode

In today’s episode, I sit down with HoneyBrick's CEO, Andy Crebar to learn about how they’re providing accredited investors access to institutional-quality CRE deals at lower minimums and increased liquidity. HoneyBricks leverages the power of blockchain to help sponsors efficiently raise and manage capital, and by doing so, is able to provide investors access with as little as $1,000.

This isn’t Andy’s first rodeo. He was the co-founder of Sapling, a People Operations platform that manages everything from onboarding, learning, HRIS, and performance, which was acquired by Kallidus in 2020. He’s now taking on the world of Commercial Real Estate investing after having some personal success in the space. And he’s leveraging blockchain to do it efficiently.

In this short interview we talked about:

Why Andy started HoneyBricks

What HoneyBricks is all about

How HoneyBricks is using blockchain to efficiently raise and manage capital for sponsors

HoneyBricks’ due diligence process and track record

What investors can expect from the platform

Thoughts on current CRE market

Andy’s outlook on CRE

Andy’s personal investing experience and tips

Top 3 takeaways

Before we jump into HoneyBricks, I want to focus on 3 noteworthy topics we discussed during the interview that any investor would benefit from.

1. Compound interest

When asked what investment advice he would give based on his experience he quoted Einstein’s famous quote on compound interest.

I personally think that’s a great nugget, not because I’ve written about it, but because this simple formula is at the core of wealth building. Understanding and applying it is so crucial.

Whenever I’m stuck in a rut I try to reflect on the “why”. Why am I feeling this way? Did I do everything in my power to change how I feel? If yes, then I often realize that I’m feeling blue, low or anxious about something that’s outside of my control. Knowing that helps reframe my mind, and refocus on things that are actually in my control.

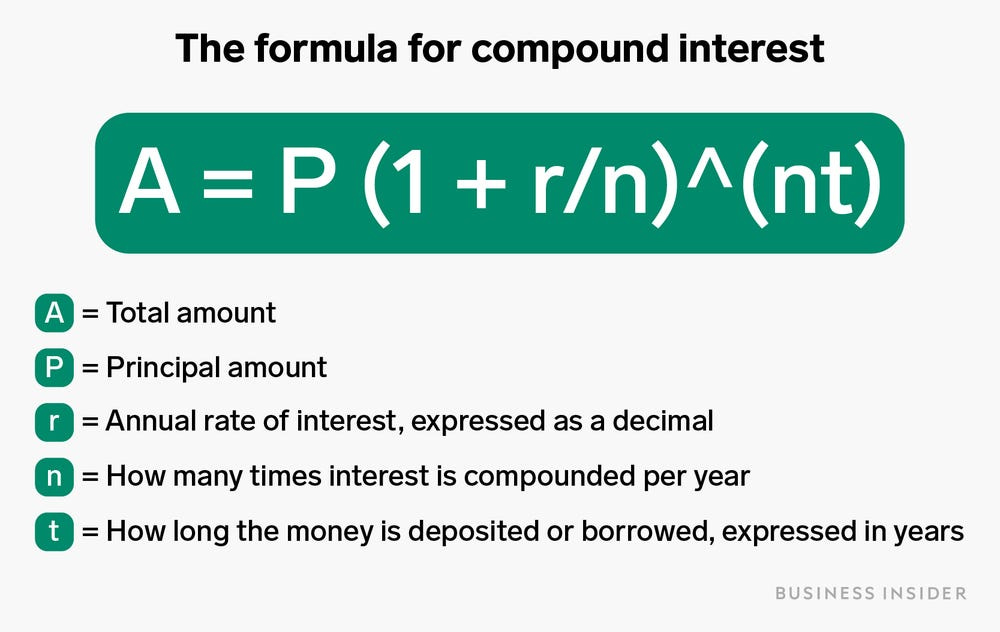

Similarly, understanding what is in our control vs. what isn’t in the compound interest formula is crucial to taking advantage of it. There is only one factor that we are all given at birth, that we don’t need to work for, that we have full control over - Time (t).

Its clear that:

Interest rate (r) is a factor that we don’t have much control over. It may go up or down, might fluctuate within a band depending on the asset class, might be negative in a year. It is externally influenced.

The number of times interest is compounded (n) is a finite number as your money can only be compounded so many times a year.

We can work hard to get a higher Principle Amount (P).

Time (t) is not only the factor we are born with that we have full control over, but it is also the exponent in the equation.

The formula favors the young - those who have the most amount of time, which is why if you’re young, you’re a time billionaire. No, I didn’t come up with that myself though I wish I did. The origin of that thought currently escapes me, but the thought is nonetheless as real as it gets. So start as early as possible and capitalize on the power of compounding.

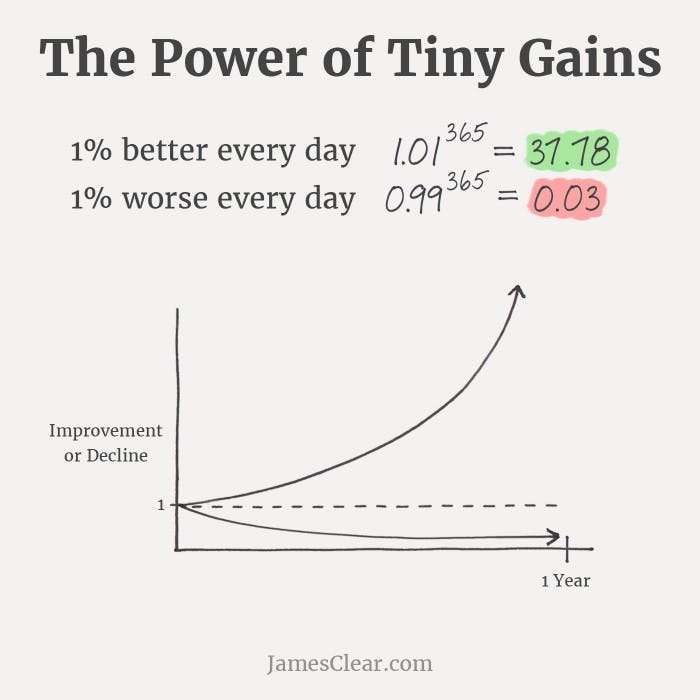

The concept of compounding is not, however, limited to money. It also applies to everything we do. If you were flying an airplane, for example, and you flew off course by just 1%, there is a great chance you'd end up on another continent. You definitely won’t end up at the place you initially intended. The same thing goes for our habits. Changing just 1% of our daily habits, behaviors or thoughts can lead us to very different places.

That’s exactly why Andy has made the concept of compounding one of the core values of HoneyBricks - it applies to building wealth, but it also applies to doing 1% better everyday to exponentially improving the odds of HoneyBricks’ success. Consistent learning, consistent improvement, consistent iterations will lead to exponentially better outcomes.

2. Depreciation benefit in Real Estate

When it comes to investing, most people are aware of the benefits of asset appreciation and of cash flow, but not every investment gives you depreciation benefits. Real Estate is one of the assets that allows you to tap into the benefits of depreciating your asset and asset-related operating expenses over time.

In this interview Andy talks about how being a direct investor in Real Estate, either by directly buying a property or investing through private placements, such as a syndication, gives investors access to the tax benefits of depreciation. This is different from investing in a Real Estate Investment Trust (REIT), which only gives access to the upside, but none of the tax benefits. This is a sizable benefit that people leave on the table when investing in REITs.

3. Multifamily Residential vs. Commercial Real Estate valuation

Andy points out that there is a key difference between how Residential Real Estate (RRE) differs from Commercial Real Estate (CRE), which is important in understanding how these markets differ.

Residential Real Estate: Pricing is typically driven by neighborhood comps (i.e., the property is valued based on similar properties in the area).

Commercial Real Estate: Priced off Net Operating Income (NOI), which reflects how the building / asset is performing. It factors in occupancy, management, rent performance, etc.

HoneyBricks Overview:

Now looking at HoneyBricks, the platform has only been live since September 2022, but there are a things that stand out to me:

For investors:

Cash flow: The fact that you receive your monthly / quarterly cash flow. Directly investing in Real Estate gives you access to 3 benefits - cash flow, appreciation, and depreciation. I like that with HoneyBricks you are a direct investor, and so you receive cash flow on your investment periodically.

Depreciation: As I talked about earlier, depreciation is the hidden-gem benefit of owning real estate, and HoneyBricks automates that for you by providing you with the relevant tax forms to claim your benefits.

Liquidity: HoneyBricks is taking a traditionally illiquid asset class and making it liquid by tokenizing ownership so that it can be easily transferred between investors.

For sponsors:

Blockchain Tech: HoneyBricks helps sponsors efficiently raise and manage their capital from a large pool of investors with ease and minimal effort.

Below is a summary of what you can expect from the HoneyBricks platform:

Access to institutional-quality multifamily CRE investments to investors at lower minimums and increased liquidity

Leverage blockchain to help sponsors efficiently raise and manage capital

Minimum Investment: $1,000

Liquidity: Can sell shares in 6-12 months

Sponsors: Mid-market sponsors with total value of deal between $10M & $50M

Completed 10-20 investments

Have had success in the past

Have experience in their niche

~1 in 20 deals make it to the platform after the review process

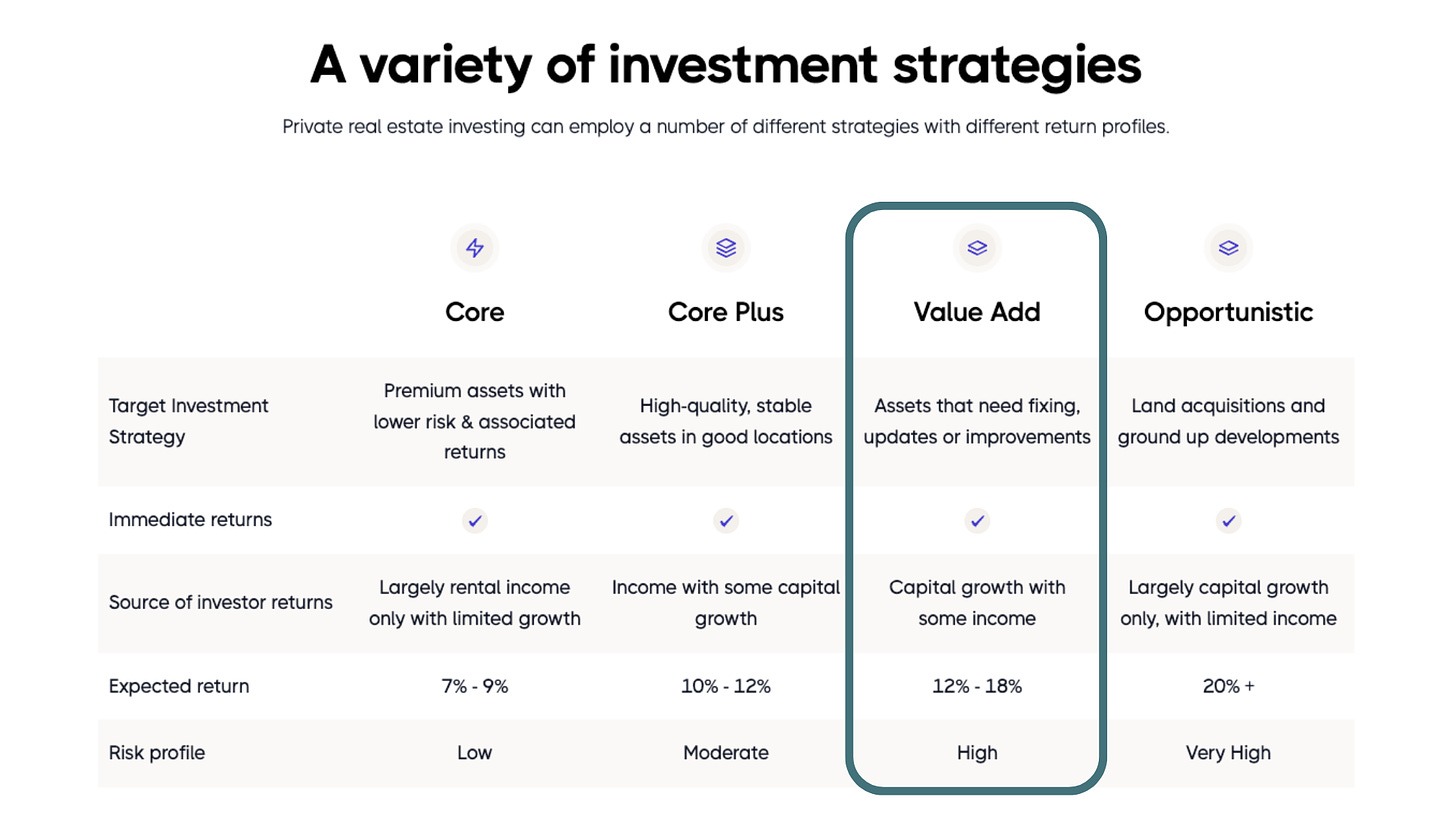

Investment Strategies

Return on investments:

Expectation: 12%-20% return

Exceptional performance: 15%-30% return

Frequency of payment: Monthly or quarterly

Only open to accredited investors

Thanks for reading!

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.

Andy Crebar: Compounding, the eighth wonder of the world