Hey friends 👋

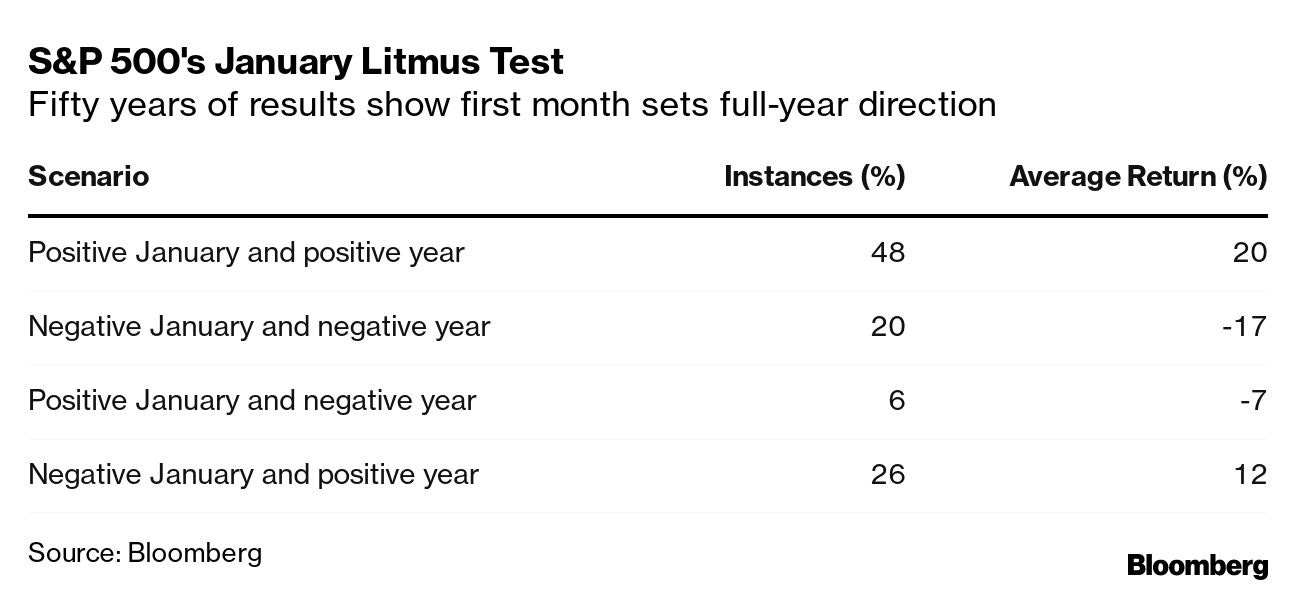

The S&P is on pace for its second-best January since the turn of the century. If history is any indicator, the index could be in the green on Dec 31. The direction in the first month has matched the annual result two-thirds of the time since 1973. However, let’s not forget the one-third. History does not always predict the future…

The good:

US GDP came in hot at 2.9%, above 2.8% expected

Inflation is continuing to slow

Earnings are driving stock prices again, but that might be short lived

The bad:

Consumers are starting to spend less

Though expected, it increases the probability of a recession

Lets dive in...

Tweets of the week

Markets & Macro

Weekly market visual

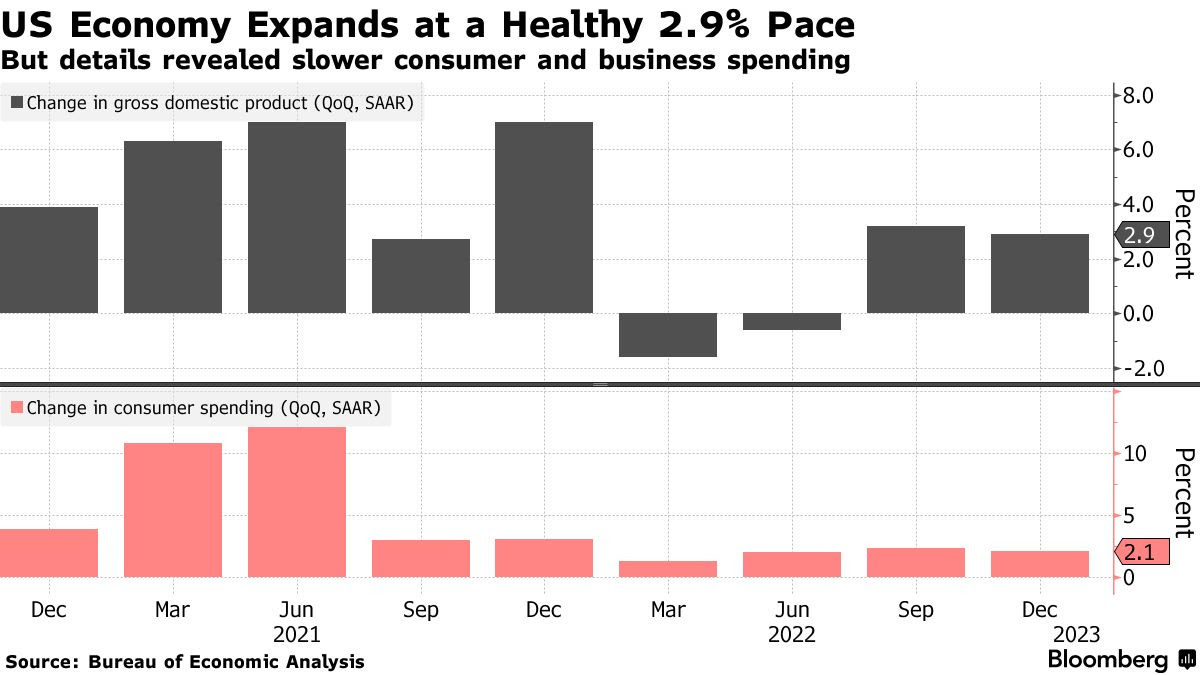

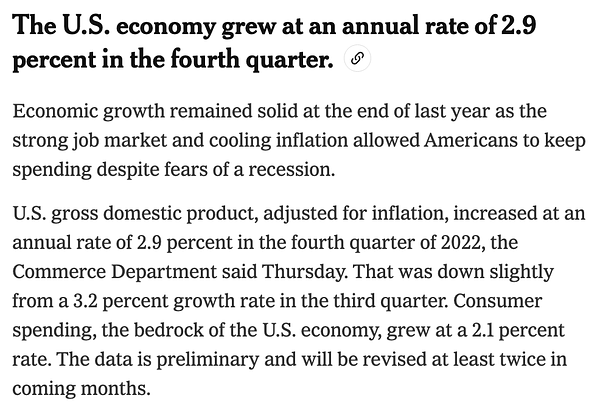

GDP rose at a 2.9% annualized pace in Q4, slightly better than expected.

Consumer spending, which accounts for about 68% of GDP, increased 2.1% for the period, down slightly from 2.3% in the previous period but still positive

A 26.7% plunge in residential fixed investment, reflecting a sharp slide in housing, served as a drag on the growth number, as did a 1.3% decline in exports

The Fed’s preferred inflation measure, personal-consumption expenditures (PCE), which captures underlying inflation after removing volatile food and energy prices, is slowly but surely edging closer towards the Fed’s target of 2%

Core PCE inflation rose 4.4% in December from a year ago compared to 4.7% in November, its smallest annual increase since October 2021

On a monthly basis, core PCE increased 0.3%, meeting estimates

Consumer spending dropped 0.2% in December, indicating that the economy slowed at the end of 2022 and contributing to expectations for a 2023 recession

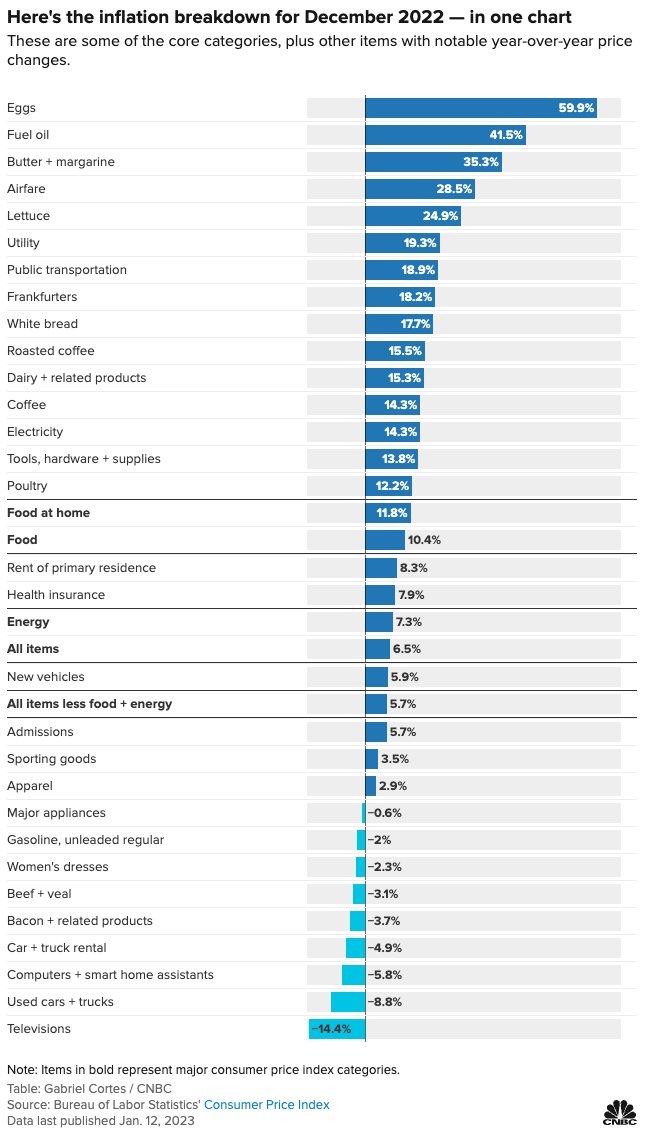

Wholesale egg prices have fallen 37% since December though still 3x their normal level; below is the inflation breakdown from Dec 2022

Banks prepare for deepest job cuts since the financial crisis

FinTech

Banks are collaborating on a digital wallet to compete with PayPal and Apple Pay using Early Warning Services LLC, the company that operates Zelle

Early Warning Services LLC is owned by 7 banks: Bank of America, Capital One, JPMorgan Chase, Wells Fargo, US Bank, PNC Bank and Truist

The new product will allow shoppers to pay at merchants’ online checkout with a wallet that will be linked to their debit and credit cards

Stripe, with ~$12B in revenue and positive EBITDA, exploring raising at least $2B at a $55B to $60B valuation, down from a $95B valuation is concerning

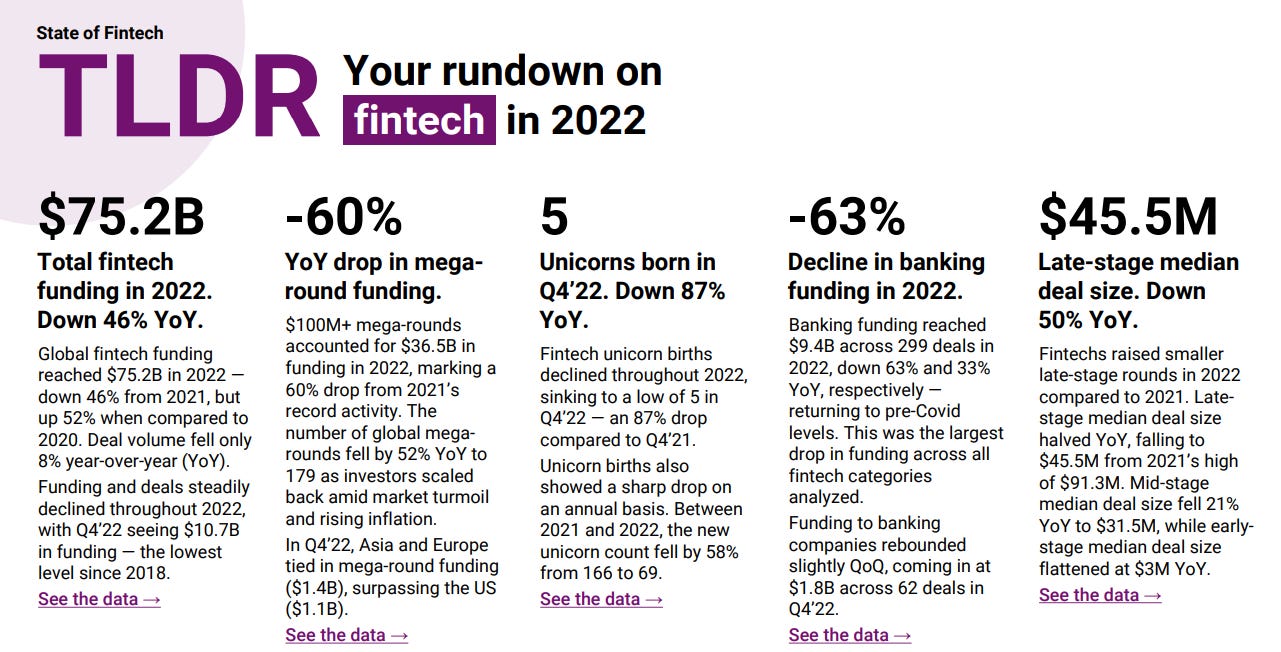

CB Insights published their year-end overview of FinTech in 2022 with all signs pointing ⬇️

Vanguard’s net investor inflows dropped to $151B in 2022, down 49.6% from the previous year

Marqeta launched web push provisioning product for mobile wallets

Capital launched a high APY business checking account that pays 4% on holdings

Melio launched integration to sync payments data with accounting platform Xero)

Upstart introduces digital finance and online sales applications to offer a fully digital auto retail experience

Zoe, a financial advisor matching platform, launched a wealth management product

Real Estate / PropTech

US housing market might be getting a breather as pending home sales climbed for the first time in more than a year to 2.9% in December

Blackstone earnings fell due to a drop in value of its real-estate investments

Harbor Group raises $1.6B for first Apartment Debt Fund

Compass and Anywhere are among the least efficient publicly traded residential brokerages, an analysis by Mike DelPrete has found

Property-services startup Lessen acquires rival, SMS Assist, for $950M

Welcome Homes raised $29M in Series A funding

Blend cuts 30% of staff

Crypto

White House calls on Congress to ‘step up its efforts’ on Crypto regulation

Prime Trust to cease operations in Texas at end of January

Other

Tesla closed at $177.9 today up 30.98% this week, and 64.57% since the start of 2023 after better-than-expected Q4 results pushing the Nasdaq and S&P 500 higher

Vehicle production

Total vehicle production of 439,701, up some 44% year-over-year

Q4 deliveries came in at 405,278, up 31% year-over-year

Revenue

Q4 revenue of $24.32B, up 37% year-over-year

Revenue total beat a Street estimate of $24.16B

Earnings

Q4 adjusted EPS of $1.19, beating estimate of $1.13

BuzzFeed up ~3x in 2 days after announcing it will use OpenAI to help create quizzes and other content

Adani Group, the Indian conglomerate, lost more than$50B in market cap after Hindenburg Research alleged on Wednesday that the company had engaged in stock price manipulation and accounting fraud

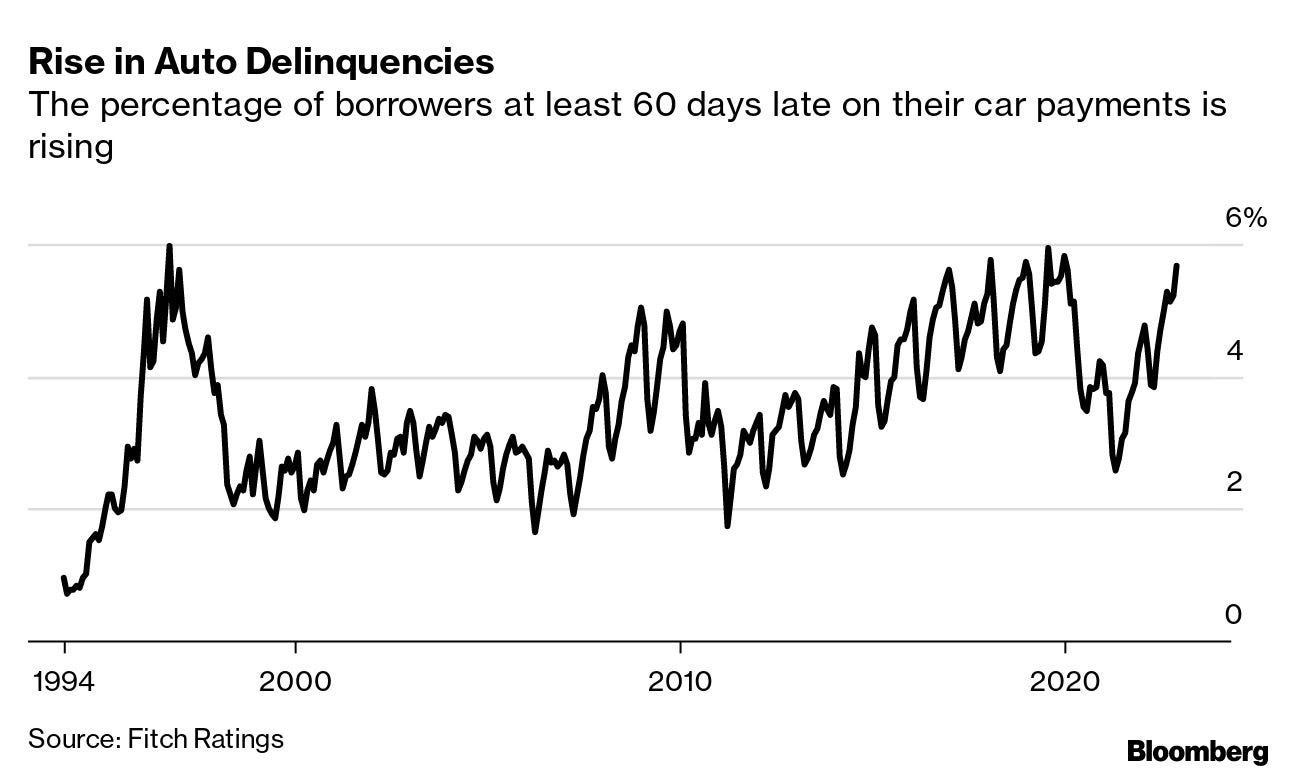

Americans are falling behind on car payments at higher rate than in 2009

Thanks for reading!

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.