Hey friends 👋

So… I went missing last week. Nothing to worry about. I (luckily) did not get caught in the Peru protests. My phone was stolen last Thursday so instead of focusing on the Weekly Drop I had to divert all my effort towards filling police reports, getting a temporary phone, blocking all my accounts, and everything else that comes with losing your phone in a foreign country. Happy to report I’m back in New York, safe and sound. Outside of my phone being stolen, Peru was phenomenal. Highly recommend a visit once the political situation calms.

Anyway, now that that’s cleared lets get to business. The US hit its $31T debt ceiling yesterday, Fed is considering a quarter-point hike, markets pulled back after their rally in the first 2 weeks of the year, BTC/ETH are soaring for some reason, and the economy and future continue to look shaky. More Big Tech layoffs, some CRE concerns and not too much happening in FinTech.

Things aren’t “wild” out there, but instead seem eerie. No one is certain of what is going to happen, but a recession continues to loom. There is chatter about whether the government can actually afford to raise interest rates or not, which is another reason the Fed is probably considering slowing hikes. Uncertainty everywhere.

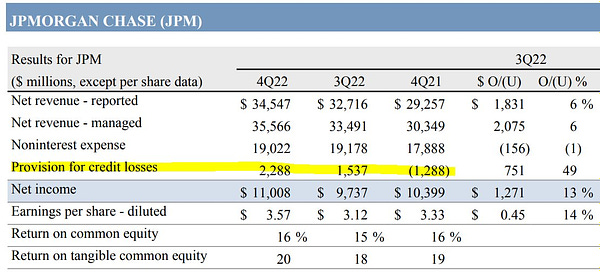

What we do know is interest rates are not going to fall anytime soon, which means debt burdens are going to remain high for the foreseeable future. That will likely lead to an increase in defaults on loans. Banks certainly seem to think so, which is why all top banks (think JMP, MS, GS, Citi, BofA, etc.) have substantially increased their provisions for credit losses (PCL).

You’re probably wondering what in the world are provisions for credit losses and why am I wasting your time talking about it. In short, its a line item on a bank’s income statement that indicates how much of their lending portfolio they expect their borrowers to default on. It represents how much they are setting aside for that future expected loss. It is effectively a forward-looking indicator of loan defaults.

Let’s take JP Morgan as an example. In Q4 2022, JP Morgan reported $2.3B quarterly provision for credit losses, the largest the bank reported since 2020. In 2019, the provision for the entire year was $5.5B.

What this means is JP Morgan is expecting $2.3B of their portfolio to fall into default in Q1 2023. The actual number could be higher or lower, but the fact is that the amount set aside for Q1 2023 has increased significantly. Provisions for credit losses reported in Q3 2022 for Q4 2022 were $1.5B, and the actual amount charged-off in Q4 2022 was $887B.

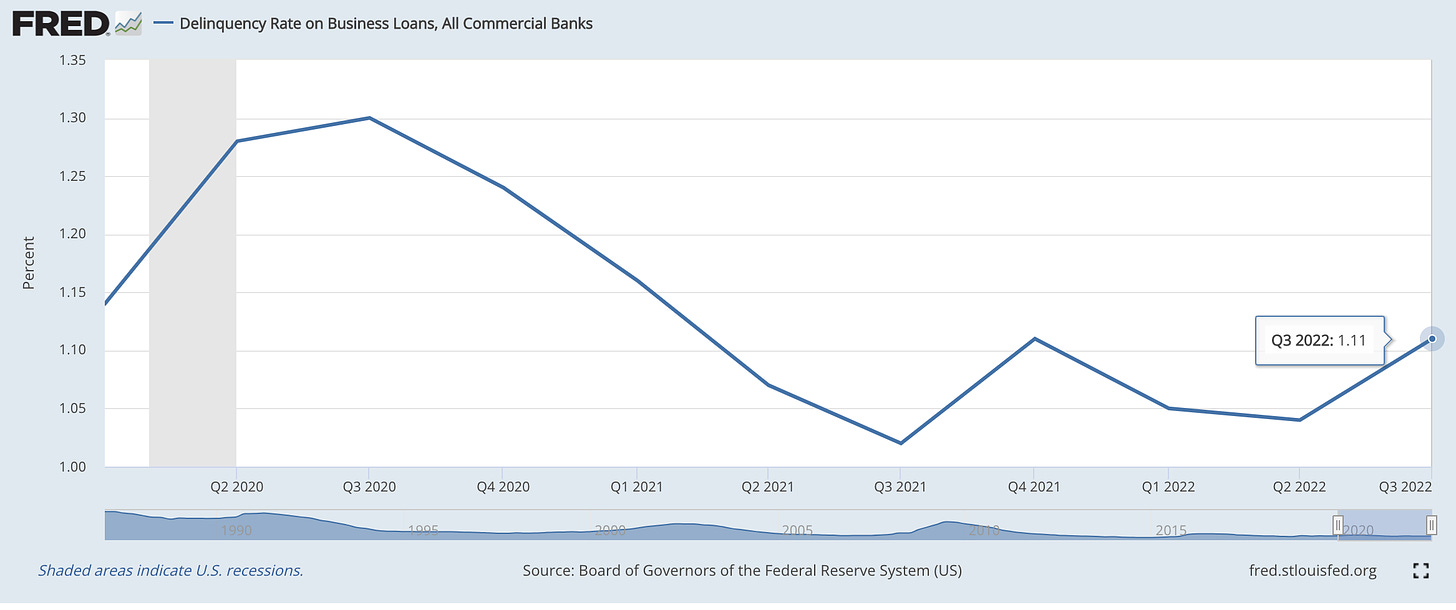

Banks’ are expecting an increase in defaults because default rates are already showing an uptick.

Credit card delinquency rates are increasing quickly

Even business loan delinquency rates are on the rise

Does this mean 2023 is ripe for a credit event? Possibly, but too early to tell. It all depends on (i) how much consumer spending ultimately slows, and (ii) whether consumers and corporates have enough capital to manage their increasing debt burdens. Time will tell.

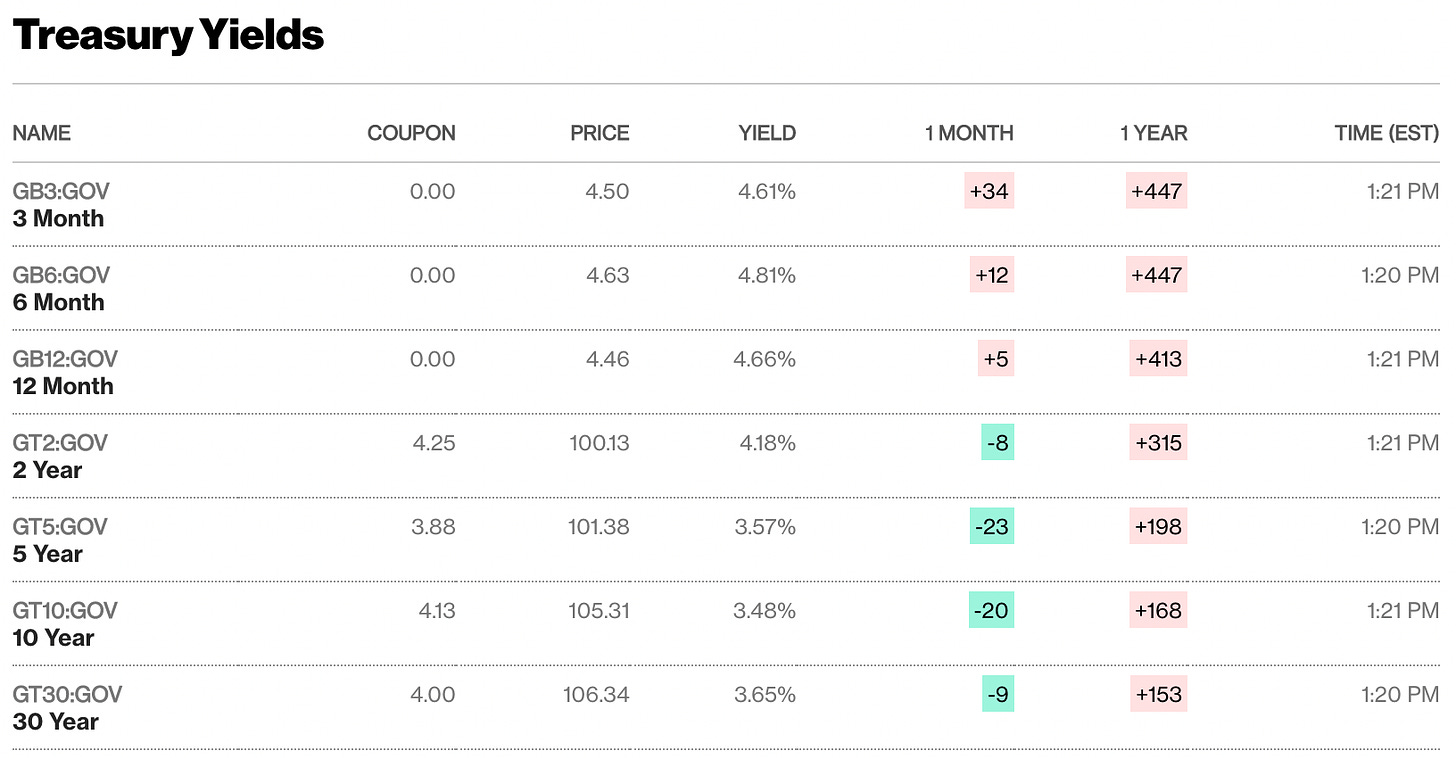

Until then, let’s make sure we don’t make any rash moves in the market. Times ahead might get tougher. A dollar saved might be a dollar made. Maximize your returns on low-risk investments.

Consider some low-risk treasury bills.

Ok ok… enough about boring accounting line items. Let’s take a look at what happened this week.

Tweets of the week

Markets & Macro

Markets gave up a gains from the first 2 weeks of 2023 this week even though today ended on a positive note

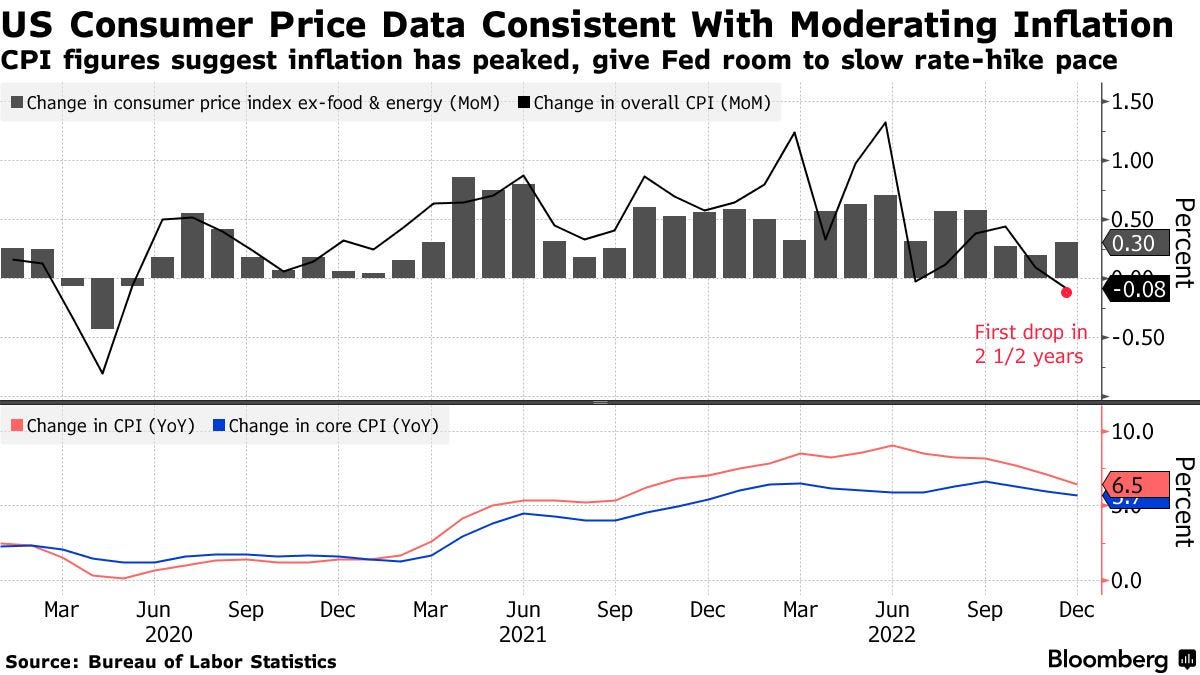

Fed may slow down interest rate hikes to a quarter-point hike at the next meeting as inflation slows

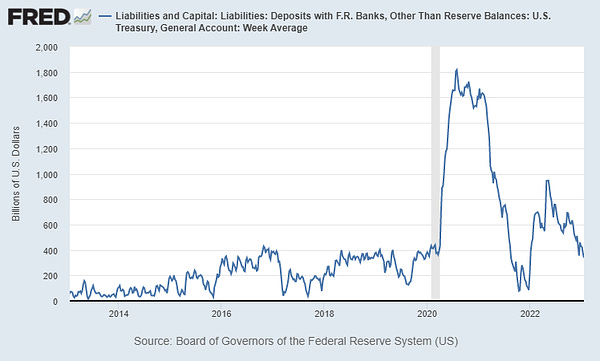

US hit the debt ceiling yesterday, prompting the Treasury to take extraordinary measures

It’s true that the US must raise the debt ceiling to avoid a financial crisis, but

The US has ALWAYS raised the debt ceiling after some traditionally necessary drama

Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents

US inflation continued to slow in December as price pressures have peaked

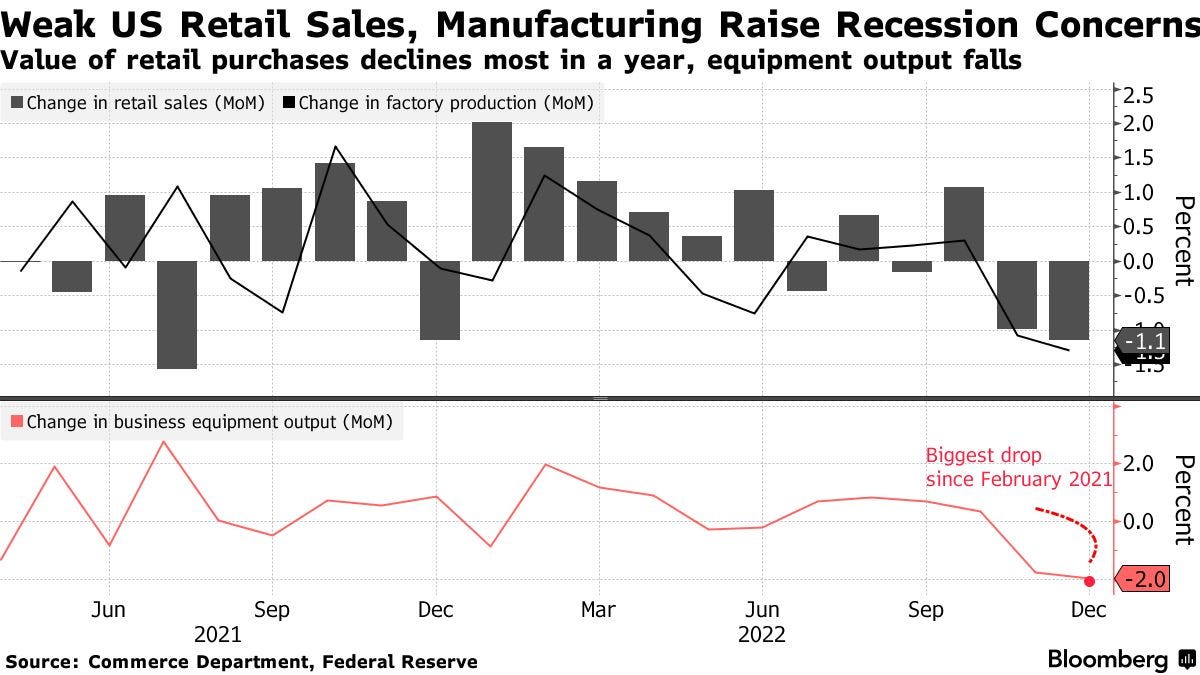

US retail sales fell more than expected in December, as did manufacturing output

Goldman Sachs and Morgan Stanley reported earnings early in the week

GS posts worst earnings miss in a decade as revenue falls while expenses rise

MS, on the other hand, posted a revenue beat, boosted by wealth management

JPMorgan’s top strategist Marko Kolanovic who, in June 2022, wrongly predicted stock market would recoup 2022 losses and end the year flat has NOW turned bearish cutting his recommended equity allocation due to fears of a recession and central bank over-tightening. He is overweight emerging markets. Seems like no one knows what’s ahead.

FinTech

JP Morgan has been quietly working in the background with Bytedance, the Chinese owner of TikTok, to build payments products for it aimed to help Bytedance expand into over two dozen more markets

Amount transacted on TikTok: $3.4B in 2022, up from $2B in 2021, and spending in the US alone more than tripled—to $670 million

Amazon is pushing into the embedded fintech game with the launch of a Buy with Prime app for merchants everywhere in the US

Public launched Treasury Accounts, a hybrid savings account / government bond account that is currently yielding 4.8%, built on Jiko’s T-Bills platform

Real Estate / PropTech

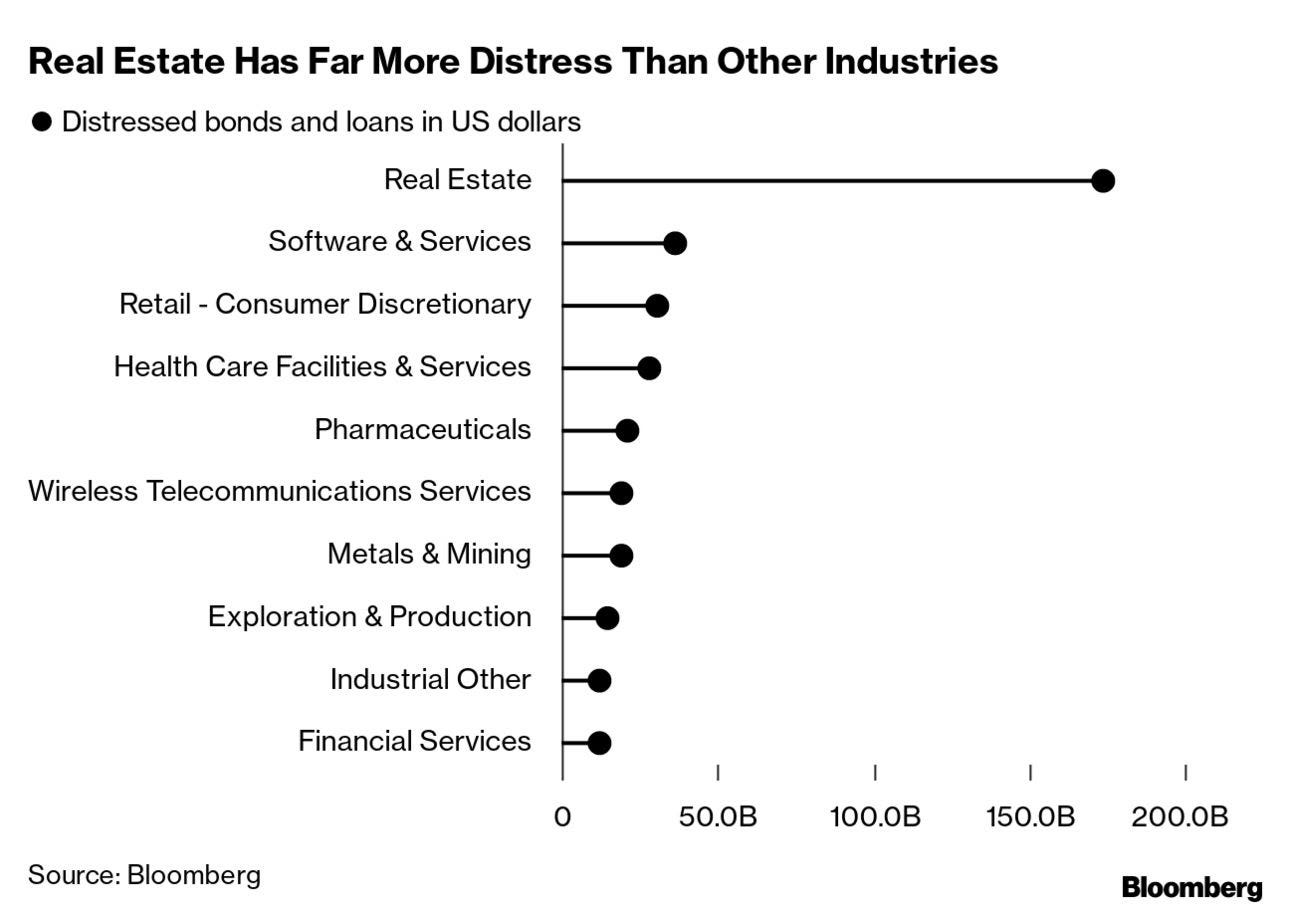

The global housing market slump is spreading to CRE, threatening to unleash a wave of debt turmoil

Some big investors in US CRE are looking to cash in before property values slide further; a group of property funds for institutional investors ended last year with $20B in withdrawal requests, the biggest waiting line since the Great Recession

Almost $175 billion is already distressed and lenders in some markets are warning borrowers of a growing risk of foreclosure

Global spiral

US commercial property values fell 9% in the second half

UK assets dropped more than 20%

One study suggests distress levels in Europe are the highest in a decade

The fall in transactions and development is bound to affect spending in the real economy and, in turn, jobs and growth

The White House is weighing a range of executive actions to authorize and expand protections for renters as Americans are struggling to afford their homes after a years-long boom in rents

Built-to-rent single-family housing forecast: Easing in 2023 & booming in 2024/2025

Crypto

Crypto broker Genesis filed for Chapter 11 bankruptcy protection late last night

JPMorgan CEo Jamie Dimon called Crypto a “pet rock” again

Bitcoin and Ether turned bullish over the past 2 weeks

FTX token surges as new CEO, John J. Ray III, says crypto exchange could be revived stating that “Everything is on the table.”

Other

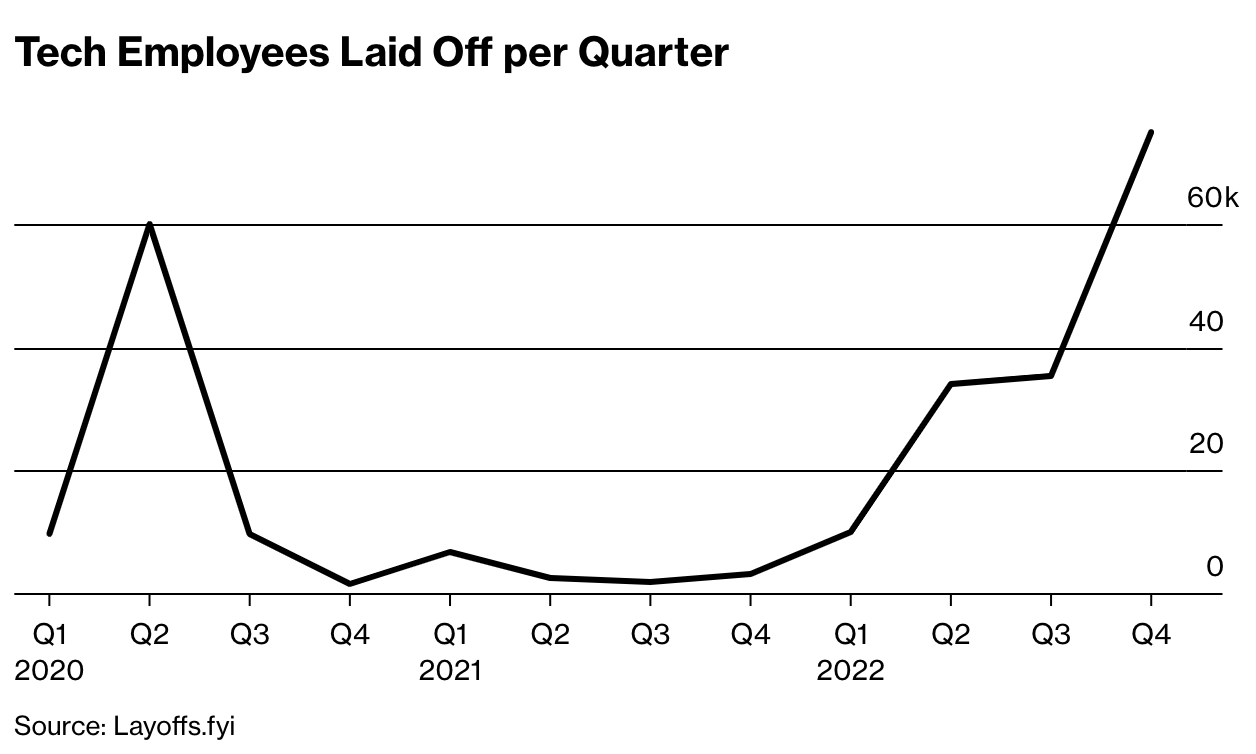

50k more Big Tech layoffs communicated this week between Microsoft (10k), Amazon (18k) and Google (12k), but reminder that Tech only represents 3% of overall labor force

Netflix CEO Reed Hastings steps down, but stay on as executive chairman

Thanks for reading!

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.