Hey friends 👋

It’s Super Bowl Sunday and I’m pumped to watch today’s game live with 100M fans! I’m personally rooting for the Chiefs, not because I support them per say, but I’m betting on the underdogs:

Point spread: Eagles -1.5 (Eagles favored to win by more than 1.5 points, otherwise Chiefs cover)

Moneyline:

Eagles -133 favorites to win (bet $10 to win $17.52 total)

Chiefs +110 underdogs to win (bet $10 to win $21 total)

Total scoring over/under: 50.5 points scored by both teams combined

This year’s Super Bowl has a few firsts:

First Super Bowl to feature two Black quarterbacks

First brother v. brother Super Bowl between the Kelce brothers

2023 Super Bowl in $$s:

$5.5K Cheapest Super Bowl ticket

$82K Losing team’s player bonus

$157K Winning team’s player bonus

$7M Average 30-second ad slot (2022: $6.5M, 2021: $5.1M)

$200M The total payroll for the Eagles this season

$212M The total payroll for the Chiefs this season

>$500M Fox Super Bowl ad revenue

$700M Total $ estimated to be bet on the game just in Arizona

$3.7B Estimated Chiefs’ franchise value (rank 23)

$4.9B Estimated Eagle’s franchise value (rank 10)

$16B Total $ estimated to be bet on the game, up from $7B last yr

$16.9B Estimated food, drinks, apparel, decorations purchases for the day

Thanks to SBF’s FTX collapse there will be no crypto ads this year, which after last year is probably for the best.

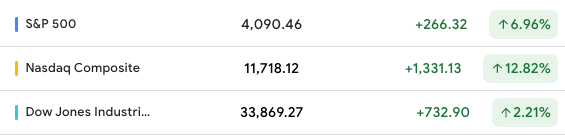

While spirits are high in anticipation of tonight’s game, the markets made a turn for the worse this week with the S&P 500 and Nasdaq posting their worst week since December.

All eyes will be on Tuesday’s CPI numbers next week.

Let’s dive in!

The Week in Review

Tweets of the week

Thoughts and prayers with those in Turkey

Markets & Macro

MARKETS SNAPSHOT

YTD

Weekly

MACRO SNAPSHOT

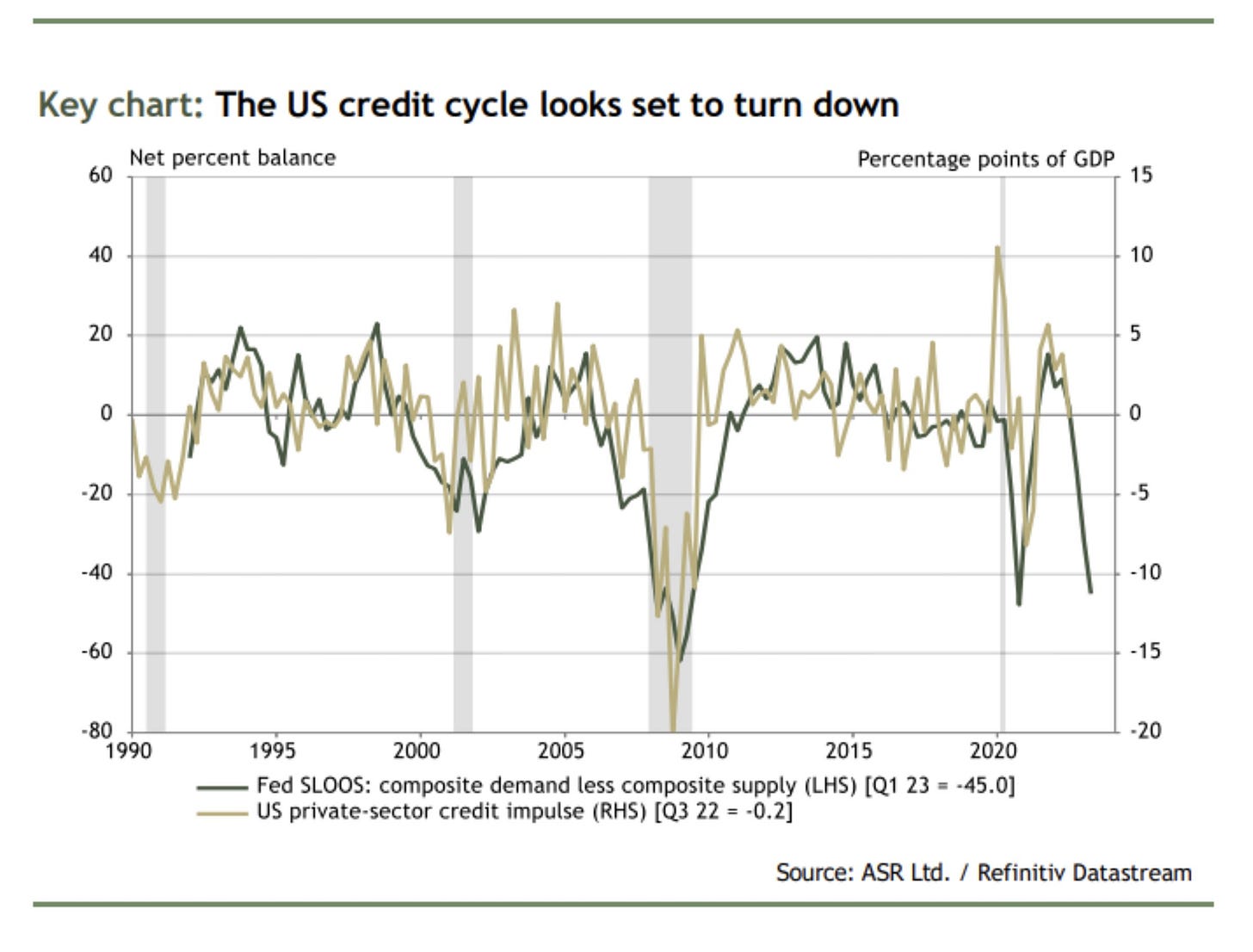

KEY ECONOMIC REPORTS | PERIOD | ACTUAL | MEDIAN | FORECAST

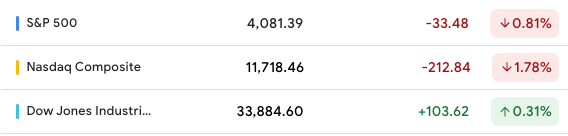

U.S. weekly jobless claims increased last week, but remain historically low | Feb 4 | 196k | 190k | 183k

Consumer credit grows at slowest pace in 2 years in sign of economic worries | Dec | $12B | $26B | $28B

Continuing jobless claims | Jan 28 | 1.69M | - - | 1.65M

SUMMARY

We’re likely experiencing history right now. It’s the first time that the Fed has aggressively increased interest rates to battle inflation, but the labor market is the strongest its been in 50 years. Recession indicators are flashing red, but the economy is still looking strong. And the markets have cheered the market’s resilience strength… until this week. Are we potentially at a turning point?

Last week, Powell told investors rates would need to remain higher for longer, but the markets took has comment, “disinflation has begun” as a win leading markets to surge. On Tuesday, he reiterated his message that further hikes were likely necessary. Markets, again, rallied higher 😐.

Now, investors are finally starting to come to terms with the fact that high interest rates are here to stay as the futures market has priced in that investors expect rates to peak slightly above 5% in July, with only one rate cut by year-end. Last week, they expected a peak of around 5% in May, with 2 rate cuts by year-end.

The Fed’s biggest concern? The strength of the labor market. A strong labor market could dampen the Fed’s effort to reduce inflation. Though jobless claims picked up last week for the first time in 6 weeks, they still remain at historic lows.

An upward revision to December’s seasonally adjusted consumer prices doesn’t help, but the change is not material enough to change the narrative that inflation is falling… hopefully.

The Bulls and the Bears are at a stalemate

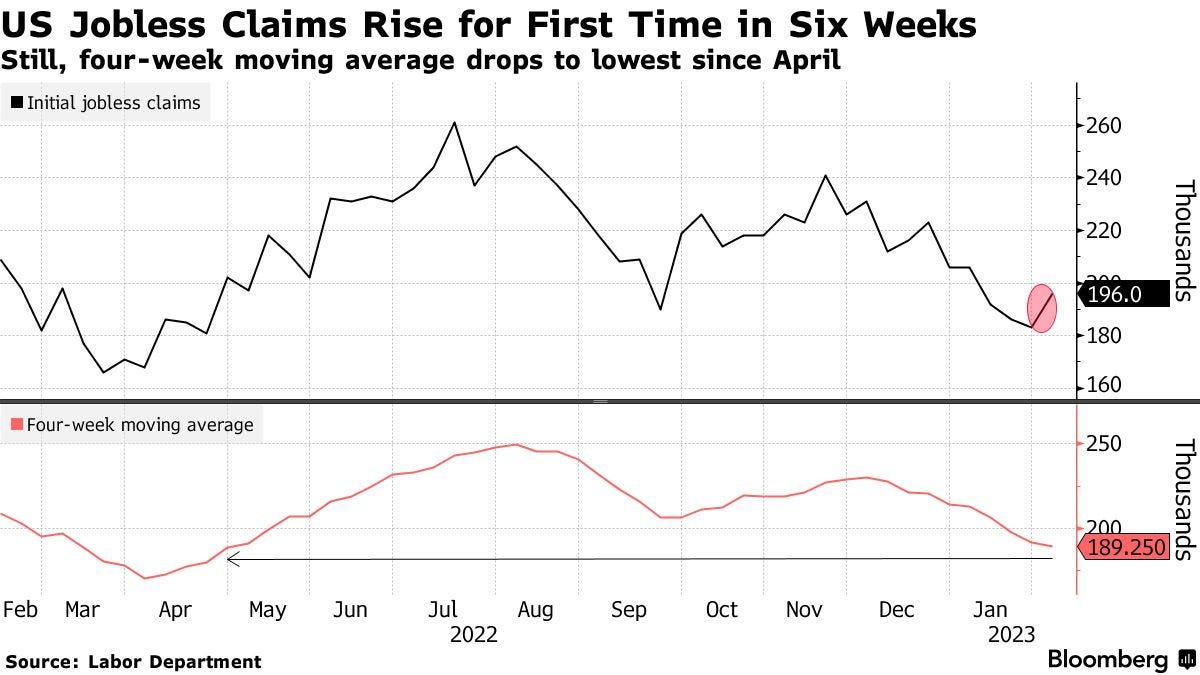

BEAR CASE

A number of recession indicators are, and have been, sounding alarms for a while now:

Credit cycle turning down

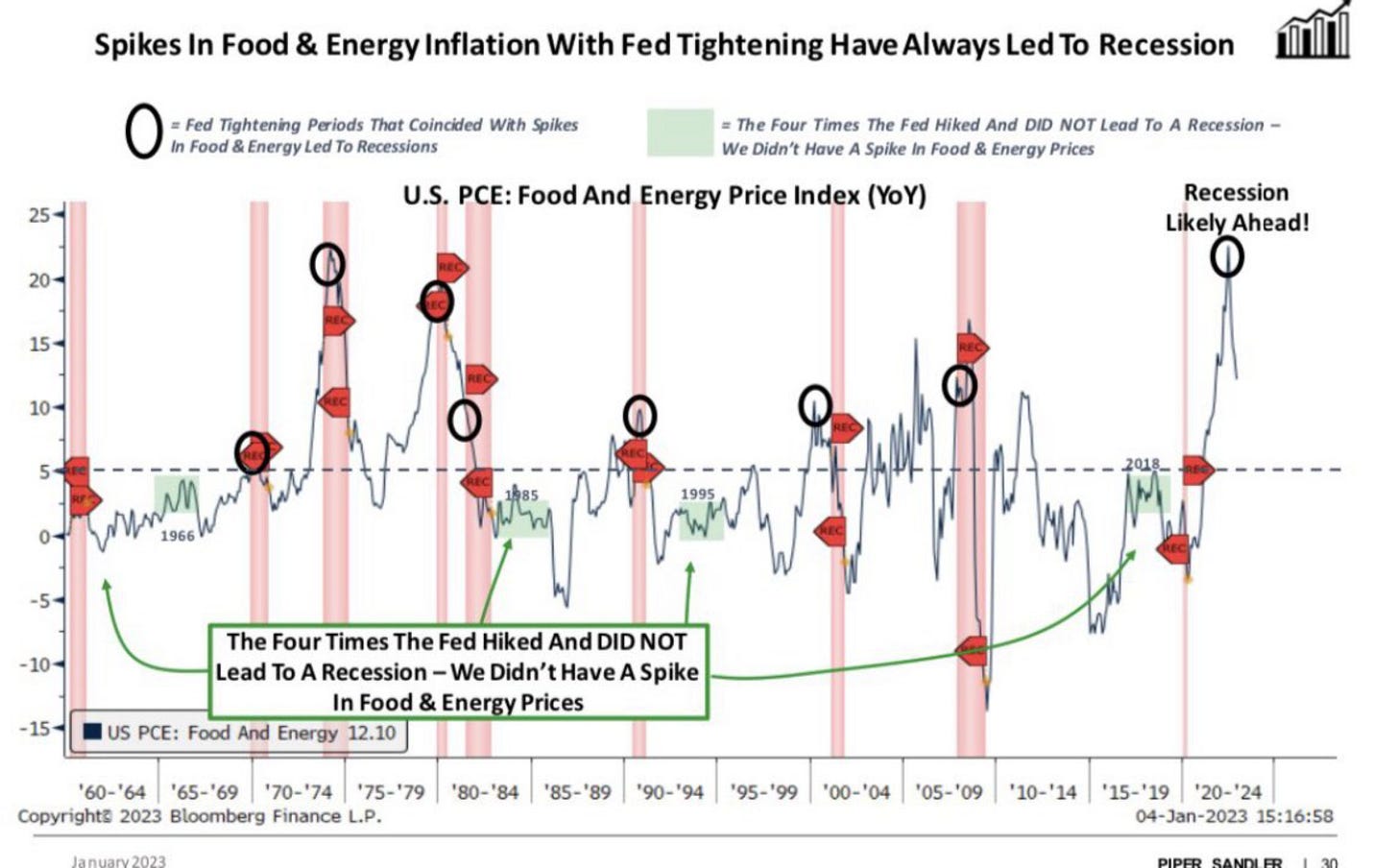

Food and energy prices spikes have always led to a recession

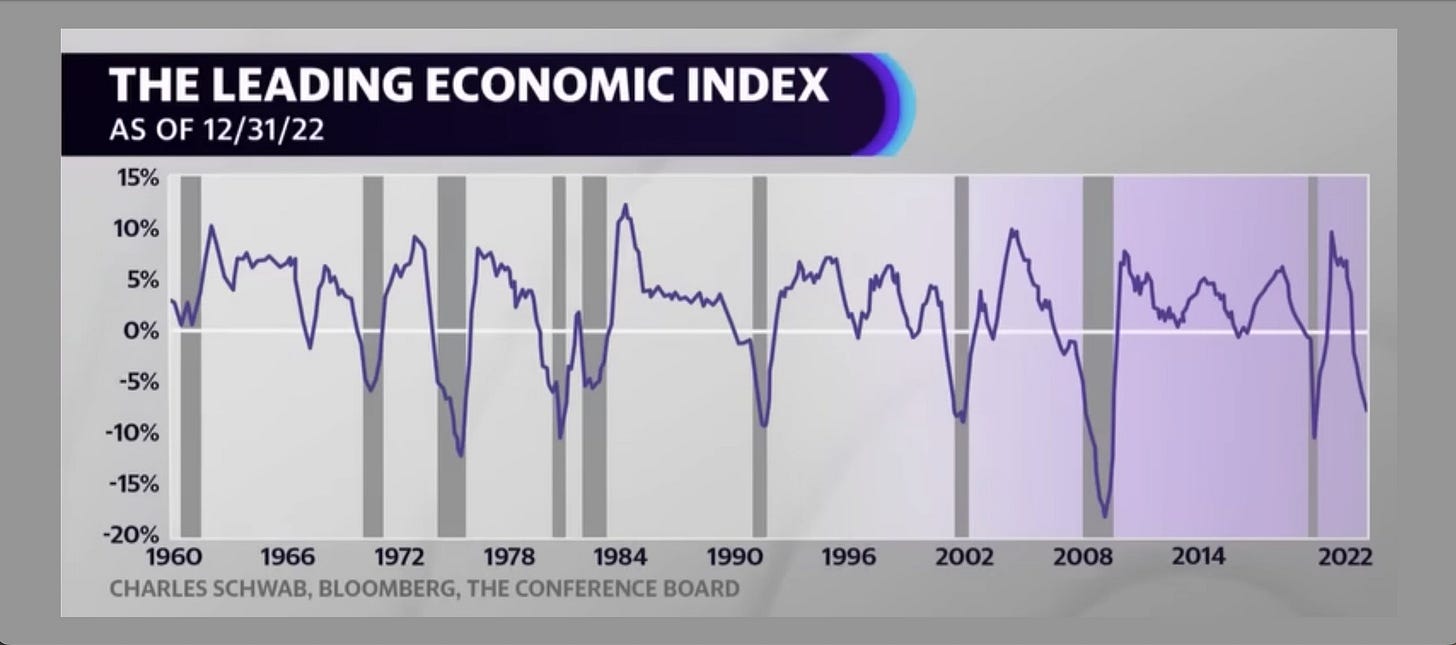

US Leading Economic Index screaming recession (no false signal since 1960)

The list goes on…

Additionally, a number of experts are also sounding the alarm on the market, which - they believe - may soon run out of steam.

Larry Summers said investors have become too complacent on inflation, and that the central bank may need to tighten more than expected.

Two top fund managers warned that the 2023 equity gains are a bear-market trap

Governor Waller warned that interest rates could go higher than expectations

Deposits at US banks continue to fall as consumers draw down on their savings, leading many banks to borrow from Fed funds to cover shortfalls - the highest borrowing rate since 2016.

BULL CASE

On the flip side the market has defied all reason and has pushed higher aggressively in January. Some technical indicators suggest the January bull market is here to stay.

Frank Gretz, a technical analyst at Wellington Shields, said in a note to clients: “Despite what might seem a logical expectation of lower prices, the market action has been quite impressive to the upside.”

NYSE stocks are trading above 200-day moving average

MY TAKE*

The January rally feels like a bull trap

The stock market has been overly optimistic about the Fed’s dovishness

Likelihood of a recession is high. The question is more when rather than if.

Will the market go higher from here through the end of the year? After a ~13% and ~7% rally in the Nasdaq and S&P 500 already… highly unlikely

Can the S&P 500 and Nasdaq be up for the year? Possibly, but that would be a best case outcome

*Disclaimer: This is not advice, just my opinion

Tuesday’s highly anticipated CPI data will shed more light on the economy’s direction.

Other

Robinhood reported a $1.3B loss (EPS -$1.17 per share) in 2022; the Board approved a plan to buy back the $578M worth of shares that was bought by former FTX CEO Sam Bankman-Fried and FTX co-founder Gary Wang last year

We finally got a glimpse into what Adam Neumann’s company, Flow, is all about in his interview with a16z founder Marc Andreessen where he talks about creating “an elevated experience for the resident,” “a feeling of ownership,” and plumbing…

All the home-buying startups are stuck holding residential real estate inventory bought at the top of the market

Tesla will unveil “Mater Plan 3” at its investor day on March 1

Google’s release of its AI Chatbot, Bard, was a flop, while OpenAI started offering a paid version of ChatGPT on Friday at$20/month

Adidas could lose around $1.3B in revenue in 2023 if it is unable to sell its existing Yeezy stock

Disney CEO, Bob Iger, is shaking up the House of the Mouse with plans to

Lay off 7,000 people (4% of work force)

Cut $5.5 billion in costs

Put content production and streaming under one roof

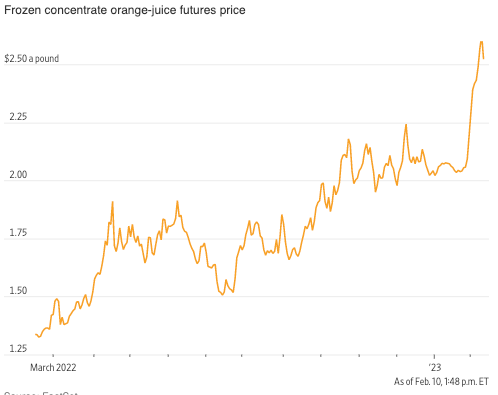

Orange juice prices are skyrocketing due to a 25% fall in orange production expectations this year compared to last

Week ahead

EARNINGS CALENDAR

The final leg of earnings season continues next week.

KEY ECONOMIC REPORTS CALENDAR

Monday

11 a.m.: NY Fed 1-year & 5-year inflation expectations

Tuesday

6 a.m.: NFIB small-business index [January]

8:30 a,m.: Consumer price index (CPI) numbers [January]

Wednesday

8:30 a.m.: Empire State Index [February]

8:30 a.m.: Retail sales [January]

9:15 a.m.: Industrial production [January]

10 a.m.: Business inventories [December]

10 a.m.: NAHB Housing Market Index [February]

Thursday

8:30 a.m.: Housing starts and building permits [January]

8:30 a.m.: Jobless claims

8:30 a.m.: Philadelphia Fed index [February]

8:30 a.m.: Producer price index [January]

Friday

8:30 a.m.: Import and export price index [January]

10 a.m.: Index of leading economic indicators [January]

Thanks for reading!

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

For short-form content check out my twitter, linkedin and instagram.

If you’d like to give me feedback or just shoot the shit, DM me on twitter.