Got equity?

The employee stock option conundrum and what tech is doing about it

Hey friends 👋

Hope you had a wonderful Christmas break and were not affected by the “bomb cyclone” that hit a large part of the US and Canada. Tis the season to be jolly, but markets have not been tra-la-la-la-la-ing. Santa may have delivered presents, but he didn’t make good on the annual Santa Claus rally this year.

Quick Tip: The last present you can give yourself before the close of the year is taking advantage of tax loss harvesting to reduce your taxes. If you sell an investment at a loss, the IRS allows you to use that loss to offset gains and income. Only catch is there is a limit to how much you can offset. If after offsetting your capital gains you still have capital losses, you cannot deduct more than $3,000 in net losses from your total annual income. So do the math before selling.

Although I’m not bullish on 2023, I’m pretty much done with 2022. As of yesterday’s close, Nasdaq was down ~34.61% YTD and the only thing certain going into 2023 is uncertainty. The Fed’s signals on interest rate hikes remain hawkish and the market is starting to realize that even if hikes stop, high interest rates are here to stay.

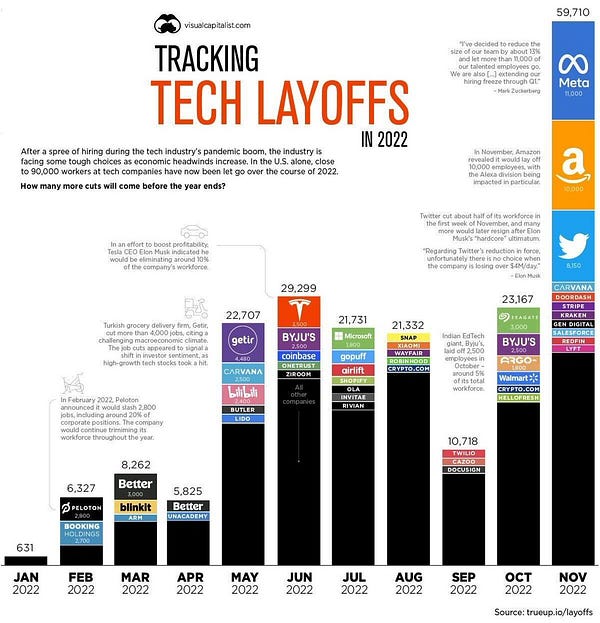

Among other things, 2022 has been characterized by massive layoffs in tech with Big Tech leading the way. We didn’t see it coming last year until the Fed admitted that inflation might not be transitory 🤦🏻♂️. In hindsight it was pretty obvious. What goes up must come down. The world is in a constant battle to maintain balance whether it be between overeating during the holidays and over-exercising in January, bull and bear markets, or over-hiring and over-firing. So here we are after more than a decade of no layoffs in tech to experience the first set of mass layoffs the industry has seen.

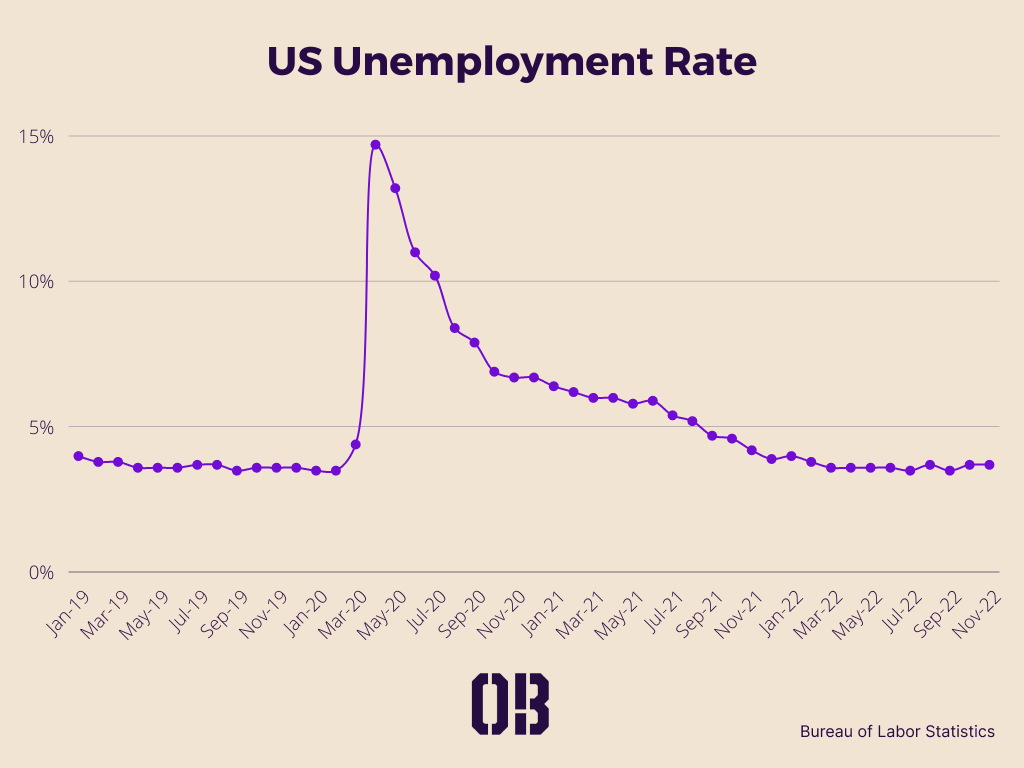

Tech layoffs, however, have barely affected unemployment in the US… so far. At 3.7% in November, the US unemployment rate has remained fairly steady over 2022. Why does unemployment seem unscathed?

Delayed capture of layoffs in unemployment numbers

Shrinking labor participation rate

Most importantly, tech only represents 3% of the US labor market, so a small percentage of layoffs results in nothing more than a rounding error

At the macro level employment numbers look astounding given a recession is predicted to be on the horizon, but on the ground employees that have been laid off are feeling some pain. The pain, however, doesn’t seem excruciating:

Severance packages are giving people time to look for other opportunities

Demand for tech employees may still be strong given the number of postings for technologists grew 25% year-over-year during the first ten months of 2022

Employees received equity compensation during the biggest tech boom, which they can hopefully cash out

I know, I know… on the last point, equity compensation does not always pay, and with significant decline in stock prices and IPO activity, the payout is smaller than expected, or absent altogether. That’s where things have gotten tricky.

To exercise or not to exercise

Most students graduate college with debt. If you managed to get a job in tech chances are your salary is around or higher than the average college graduate starting salary of $55,260 and you received an equity compensation package - your gateway into the world of assets, and your first step in the world of building wealth. Great start! Things are looking up.

Fast forward to 2022, some or all of your equity compensation has vested, but the word “inflation” is synonymous with “economy”, markets are blowing up and employers are laying off. With only a 90 day exercise window post termination, the question of whether or not to exercise your options is top of mind. The question, however, is neither new nor simple to answer. The cost of exercising options (yes, your vested equity isn’t free; you need to come up with cash to purchase it) and the potential tax implications need to be considered to determine whether you’re “in the money”.

For public company equity, the calculation is relatively simple given the equity value is known and shares are liquid. These companies have already had exits. They’ve “made it”, and hopefully so have you. But for private startups it’s a whole different ballgame. Conventional wisdom says that startup equity is worthless, and for good reason. Most startups fail. However, there is a small chance your startup equity will become a life-changing pot of money contingent on some sort of liquidity event.

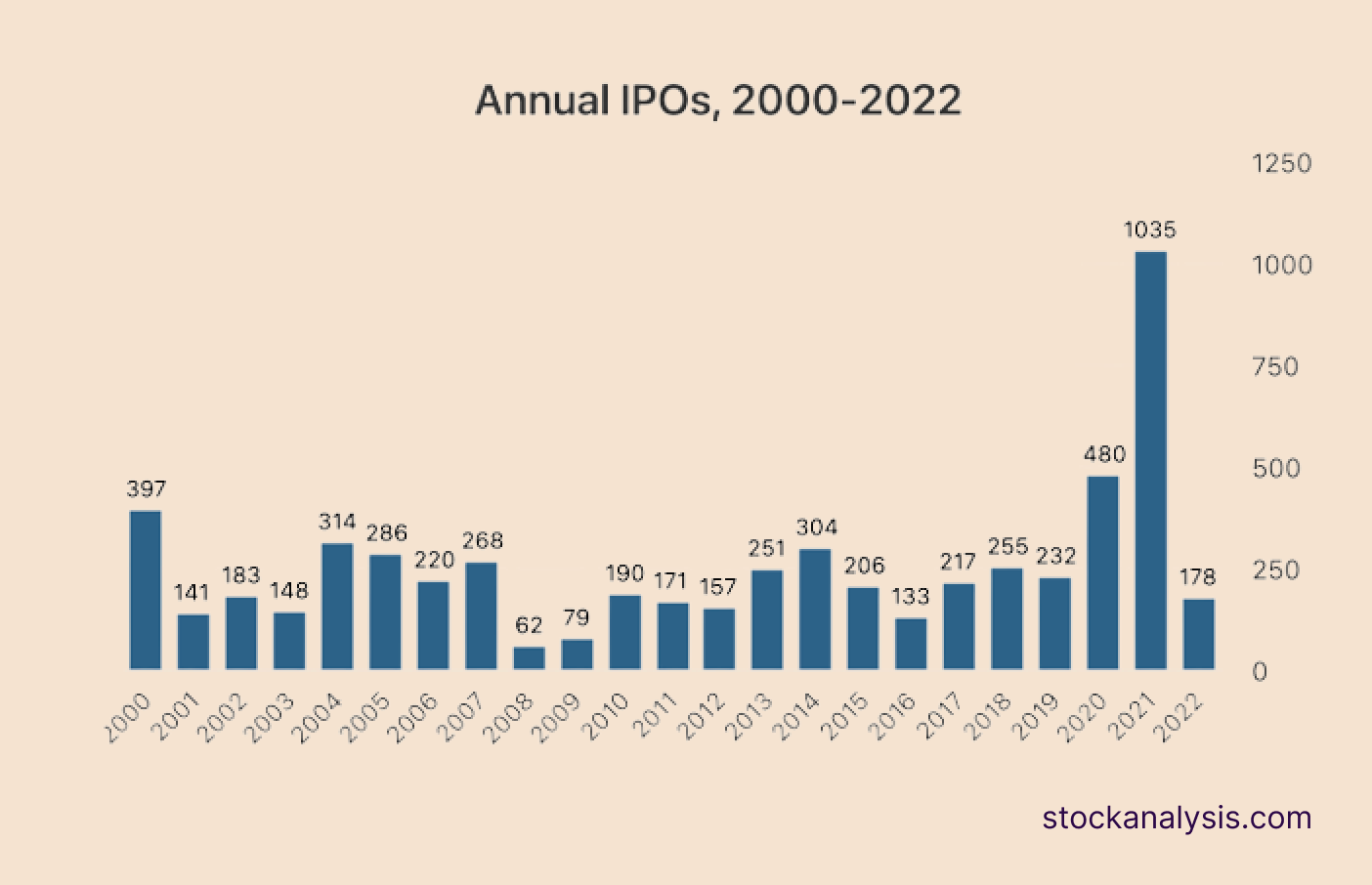

A year ago rates were low, capital was plenty and private company valuations were skyrocketing. Taking IPOs as a proxy for liquidity events, in the US there were 1,035 IPOs in 2021, more than 2x 2020 (480), and ~4.5x 2019 (232). Looking at that trend, exercising options might have seemed like an easy decision.

Note: Each exercise decision is different and should be evaluated on a case-by-case basis

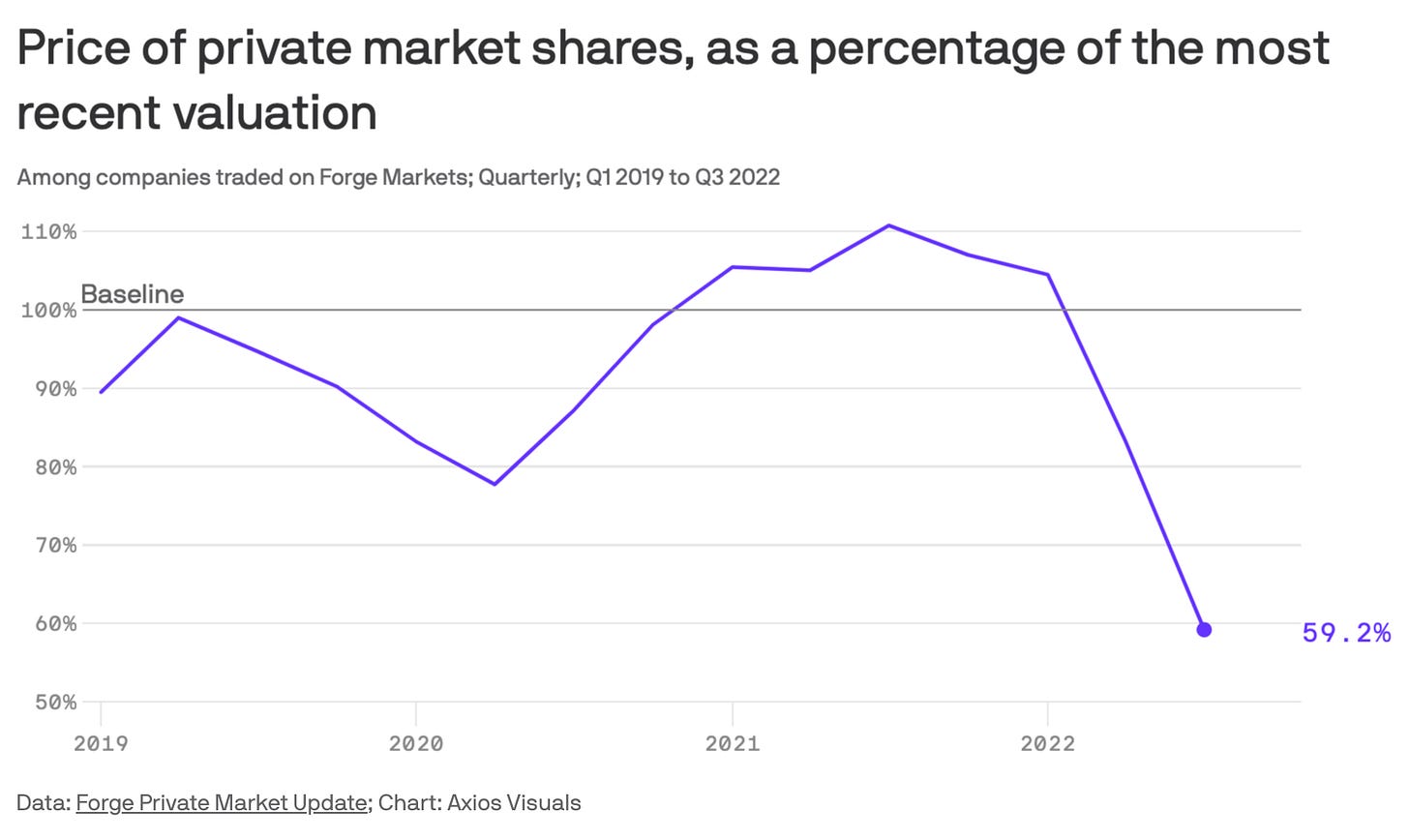

With the outsized boom in 2021, everyone from venture capital, private equity, mutual funds and family offices were interested in private shares. However, employees not typically flushed with savings struggled to come up with the cash required to exercise their options. Companies like Forge and Carta help match buyers and sellers to solve this problem. Others like SecFi and Quid offer loans to tech employees using their stock options as collateral.

Turns out, a lot of decisions to exercise in 2021, though seemingly plausible, were far from right. There have only been 178 IPOs in 2022, only ~17% of those seen in 2021. Additionally, as of October 2022, shares of private tech companies traded at a median discount of 47% compared with their most recent primary fund-raising valuation, according to Forge based on private company shares traded on their platform.

Going from ~0% interest rates to monthly aggressive increases has fundamentally shifted the economic landscape to no longer favor growth. These external factors have made the decision to exercise stock options even more complicated. Will tech experience a comeback next year? In the next 3 years? in the next 10 years? Will your company be one of the few that drives that comeback? Will your strike price be worth the investment? Your guess is as good as mine.

What’s your return on investment?

Stock options are a great way to compensate employees. When you receive your employment offer, you get x shares at a y strike price that typically vests over 4 years on top of a salary. Employees get ownership in the company and a taste of the upside if the company knocks it out of the park. Great incentive to outperform. It’s also great for pissing contests among friends and colleagues on who has more shares. The clout and the hype are hard to break away from.

But exercising your options doesn’t always make sense. It’s hard to get away from the FOMO of exercising your options. With big tech immersed into our daily lives, it’s hard not to think about how equity ownership in these companies drove wealth creation and built Silicon Valley as we know it today. But, not all startups are created equal. Only a few startups will have that grand exit.

The decision to exercise is, and should be treated as, an investment decision. Like any other investment, you have to put cash down to get exposure to the potential upside. When deciding where to invest, VCs are looking for that 100x exit. Assuming a 100x exit requires the company to hit unicorn status, they would have to invest at or below a $10mn valuation. Knowing very well the likelihood of that happening is extremely low, they invest in numerous startups with unicorn potential with the hope that a few good bets will more than justify the risky investment strategy.

Employees, on the other hand, end up highly concentrated in their employer’s company. This is not necessarily a bad thing, especially if you strongly believe that the company is going places, which is hopefully the reason you exercised in the first place. For example, exercising employee options at Google, Facebook, Netflix, etc. prior to IPO paid multifold. But from an investment perspective it is a highly risky strategy. You seldom hear about the companies that didn’t have an exit event, which far outnumber the companies that do. If you have the cash to adequately diversify your employer stock position, amazing! You’re in better financial standing than most. But most people don’t have that kind of liquidity sitting around.

A business only has a 0.00006% chance of becoming a unicorn, or approximately 1 in 1.67 million. It also takes an average of seven years for nascent startups to grow into unicorns. AngelList also performed a study concluding that startups that raised money on their platform had a 1 in 40 shot (or 2.5%) of becoming a unicorn. However, given the study was conducted in mid-2021 with a dataset of only ~2,600 seed stage companies dating back to 2013, that number seems highly skewed. I would guess the actual probability may not be as low as 0.00006%, but close to it.

The probability of winning the $1mn Megaball lottery by getting 5 numbers correct is 1 in 12.6mn. The odds of winning the Megaball jackpot (i.e., 5 numbers and the Mega Ball) is 1 in 302.6mn.

Investing in a startup isn’t like playing the lottery at all. There is some luck involved, but there are a number of factors that can be controlled to help improve your odds of picking the winner. VCs spend time doing their due diligence on their potential return on investment by ensuring that they fully weigh all the information they have available appropriately to make an informed decision. Employees should do the same.

So what factors should you look at to determine whether or not to exercise your options? It depends on a number of things, but here are a few worth evaluating:

Founders and leadership team: The founders at most startups make or break the company. It’s hard to create a framework to predict which founders will be successful, but it’s worth making an educated guess based on how they operate.

Do you believe in the founder and his vision?

Do you believe in the leadership team?

Are you convinced of their ability to aggressively grow the company?

Do you believe in their ability to trigger a liquidity event? (e.g., IPO, sale, etc.)

Investors: It’s important to consider which VCs and angels are backing the company, but it shouldn’t be your sole criteria. Keep in mind VCs are incentivized to help their portfolio companies stay afloat by raising additional capital even if they are doing poorly, so having good VCs doesn’t always mean the company is going to be successful.

Is the company backed by top, selective VC firms and investors?

Are they investing sizeable sums every round?

Is the company able to take advantage of network effects generated by their stakeholders?

Company: Being an employee at the company you have the unique advantage of knowing how things are going on the ground.

Does the target addressable market (TAM) give the company the potential to become a unicorn?

Is the company’s product gaining traction? Has it reached product market fit?

Are monthly, quarterly, annual growth numbers being met/exceeded? Is it organic or acquired? What is your opinion on future growth trajectory?

Does the company have a competitive advantages that gives it an unfair leg-up to be a dominant player in the industry?

The numbers: To truly understand whether to exercise or not, you must look at the numbers. Ideally, you should come up with a projected, probabilistic return on investment for exercising your stock options.

What is your strike price relative to the last valuation round?

Talk to a tax attorney to understand the potential tax implications of exercising to understand your total cost.

Considering your strike price and the tax implications, are you “in the money”? (i.e., is the value of your options greater than the combined value of the cost of exercising your options and the tax implications)

What is the internal rate of return on your investment after factoring in how much time it might take to see a payout?

What is the opportunity cost of the investment? Is that rate of return higher than investing in another asset, for example, the S&P 500 that has given a ~8% return on average over a 40 year period?

Do you have the liquidity needed to exercise your options? Consider your current liquidity, movable assets, near-term liabilities, and financial goals.

The analysis is isn’t straight forward. There is no right or wrong answer. But performing it can help give an indication of whether exercising your options is worth it. That being said, even if you are convinced that the company will have an exit event, unexpected events can still change everything. WeWork is a prime example of a company that had to pull its IPO just 2 weeks before going public as its valuation crumbled from $47bn to $10bn. Every WeWork employee thought their equity was going to be liquid in 2 weeks and they would have the option to cash out. For most, exercising their options was a bad investment.

Tech solutions for your equity conundrum

A number of tech firms have created solutions to help solve for the employee equity problem. Carta, for example, has published a guide on “What does it mean to exercise stock options” and has also conducted this crash course in protecting your equity when you’ve been let go. Both great resources.

In 2019, Jordan Gonen and Jacob Schein also noticed the difficulties around managing their employee equity along with tracking their assets and getting help with investing and paying taxes, They felt that traditional financial institutions and robo-advisors didn’t provide simple or holistic solutions tailored to people with assets like employee options. !,300+ tech employee interviews later they raised money to launch Compound.

“A lot of clients come to us around catalyst events. They’re deciding whether or not to exercise their stock options, thinking about if they should get a loan to exercise their options … Should they move states? How do they diversify after a liquidity event? How much can they afford to angel invest? What Compound does is provide an all-in-one platform to answer those questions.”

Jordan Gonen

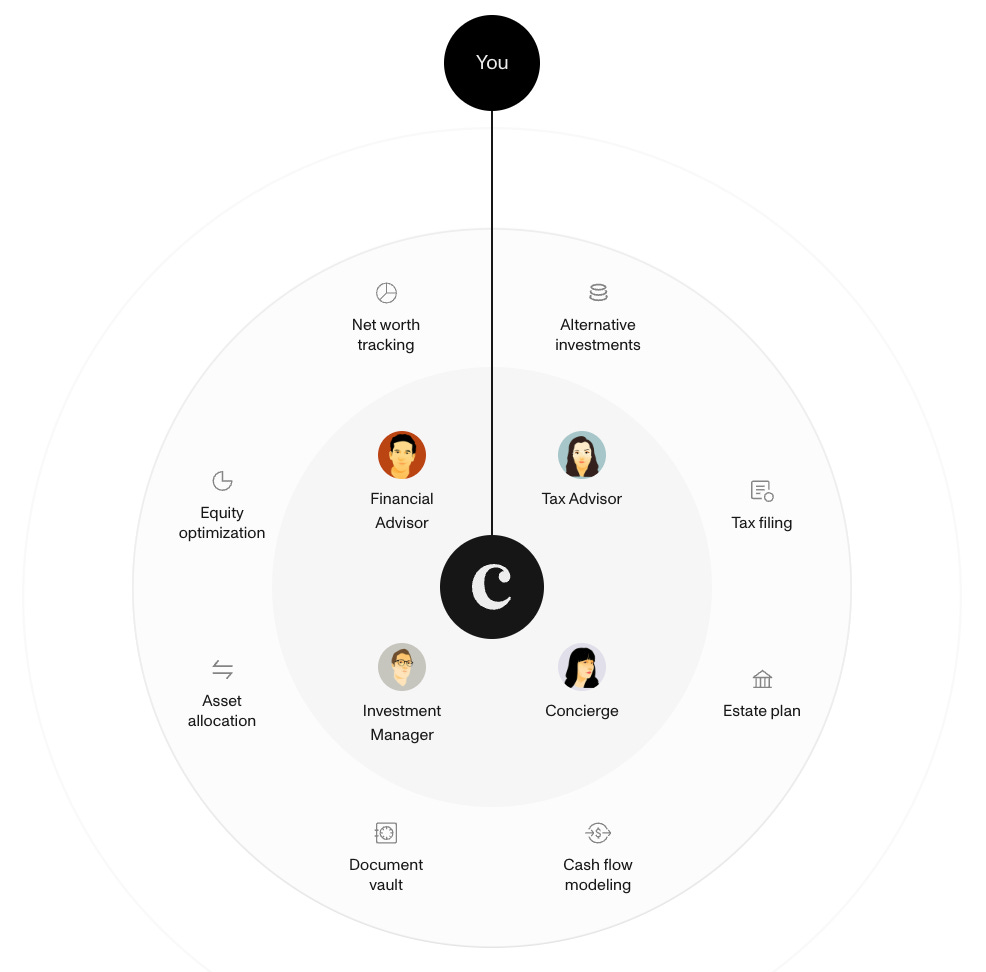

Compound describes themselves as “your personal finance department” and “wealth management for people from leading tech companies.” Unlike most wealth management firms, they do not have a minimum asset requirement. They currently have a waitlist to sign up.

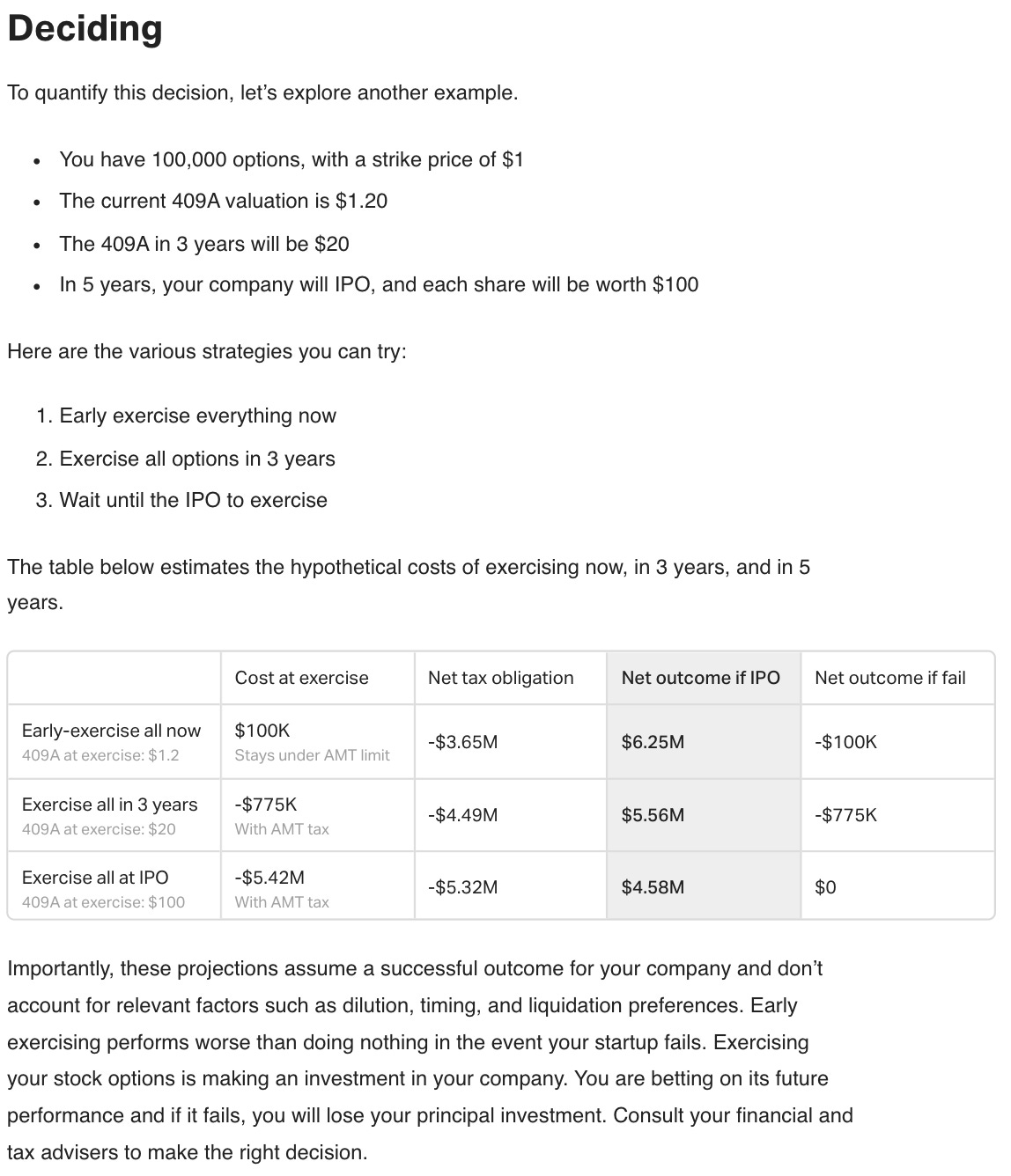

Compound entered the space solving for the employee equity issue. They have published a number of manuals to help tech employees understand the intricacies around stock options. This guide (screenshot below) walks through an example of quantifying your exercise decision looking at 3 scenarios - early exercise (now), exercise in 3 years, and wait until IPO to exercise, to showcase the tax implications and overall returns.

In January they raised a $25mn Series B. Compound has since grown into an all-in-one wealth management platform for tech employees centered around a wealth dashboard with visibility into public and private assets bundled with financial advisors, tax advisors and investment managers. They offer:

Automated net worth tracking

Exclusive access to alternative investments

Optimized startup equity

A peer network that accelerates your growth

No surprise tax planning and filing

Comprehensive asset allocation

File system to keep your financial life organized

Protected assets with a custom estate plan

Compound isn’t the only tech company building a wealth management platform that offers employee equity advice. Savvy Wealth, a Series A company that raised $11mn in November bringing their total raise to $18.3mn, is building proprietary technology, sales and marketing, and other tools to help wealth advisors become more efficient. In the process they also aim to provide end clients with better advice and an overall better experience. Concentrated stock equity planning is one of their core offerings, which includes:

How to hedge or diversify your concentrated and often illiquid position

Liquidity event planning (pre event and post event management)

Option exercising plan (including access to lending products to help with exercising)

Additionally, they provide:

Private market opportunities

Private investment management

Access to exclusive private market investments

Deal evaluation for venture investment opportunities

Tax Optimization

Direct indexed tax-loss harvesting

Private Placement Life Insurance (super-funded Roth account)

Charitable Lead Annuity Trusts and Charitable Remainder Unitrust

Mega backdoor Roth 401(k)

If you’re in tech and are looking to get your finances in order I encourage you to check these companies out.

Thanks for reading!

If you enjoy this post please like ❤️ , subscribe 🔔 and/or share!

If you’d like to chat, give me feedback or educate me on something you think I should have touched on, DM me on twitter.