Hey friends 👋

Its finally 4:44pm on Friday and if you're like me you’re probably looking forward to cracking open a nice, cold brew (cheers! 🍻). Here in New York we’ve been blessed with great weather considering its the first week of November. I’m personally going to spend most of my weekend outdoors.

The week in the market on the other hand has kept up with the craziness we’ve seen for majority of the year. So pretty much status quo.

Amazon’s market cap fell below $1 trillion for the first time since April 2020 (shocker)

Now that we’ve covered current events, lets jump into today’s topic - money, or rather, personal finance. I picked this topic for my first post because not only is it foundational to our lives, but its also foundational to this newsletter.

When we hear “finance”, we instantly think money. And not without reason! Investopedia defines personal finance as “managing your money as well as saving and investing”. Songs we listen to center around money (queue Pink Floyd’s “Money”), not around finance. “Finance” isn’t sexy, “money” is. It’s tangible. We can see it, feel it, make it, spend it, compare it. It’s universal. Everyone understands it. Or do they?

Money, in reality, is (or at least should be) only one aspect of personal finance. I understand this now after making numerous financial mistakes, but didn’t realize this growing up. I didn’t grow up in the United States, but its no secret that personal finance is not taught in schools here either. Even a college education in finance doesn’t guarantee learning the fundamentals of personal finance. Business schools focus on finance in business, not for individuals. I studied Finance at the University of Michigan - Ross School of Business. Though I learned concepts that I apply to my personal finances, I can’t say I received an education in managing my personal finances.

What’s the fuss? Why bother with personal finance?

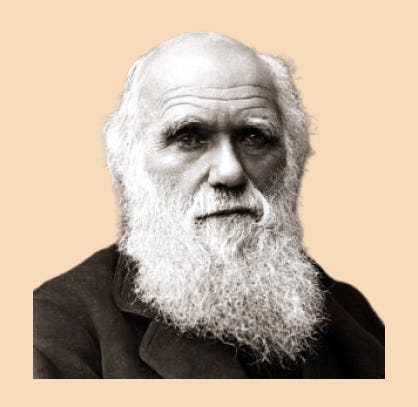

In short, I believe being financial literate is one way to level the playing field in modern human society. We’re all familiar with Darwin’s theory of natural selection, the process through which species adapt to their environments. Darwin explained that it is the environment, or nature itself, that "selects" which individuals are best adapted to it or are best "fit”. This theory was rebranded to “survival of the fittest.”

I would argue that one measure of “fitness” in modern society is financial literacy. Taking the laws of nature as given, we live in a world built by people for people. The “environment” in modern human society is synonymous with manmade laws or rules that govern it, and “fitness” is one’s ability to adapt to, or take advantage of, that environment. The laws of finance are one set of these manmade laws. They existed before I came into this world, have changed (albeit minimally) over time, and will continue to exist after I’m gone.

Like nature, the laws of finance are not fair. At birth, our access to resources are solely dependent on the resources of the family we are born into. These resources are influenced by, for example, laws around the transfer of wealth. If born into a family that has built wealth over generations, we have access to that wealth and the resources it would afford. We only have access to this wealth because there are laws in our society that allow the transfer of wealth from one generation to the next through, for example. estate planning. What if, conversely, we lived in a world where transfer of wealth was illegal? It would be a very different playing field.

The point here is that our society is governed by financial rules and knowledge of those rules, or financial literacy, can level the competitive playing field ever so slightly. Not being financially literate would be similar to trying to win at Monopoly without knowing the rules of the game. Winning would be a stroke of luck, like rolling the dice. As exciting as that might sound on occasion depending on luck for your entire life isn’t a smart choice. Yet we play the game of life without understanding the fundamentals of the financial laws that govern it. Since money can buy knowledge, those born into wealth have hired hands to manage their finances, and so are able to take advantage of financial laws. The rest of us, however, should aim to be financially literate. Being financially literate will help speed up the process of you being able to afford that hired hand.

In the absence of formal financial education options, our financial literacy is limited to personal experiences (learning by doing) and our curiosity on the matter driving us to read up on it. Inevitably, we face obstacles in life, we learn from them, and improve our personal finances. The internet, “the great democratizer”, is swimming with people trying to fill the financial literacy gap. Bloggers, Tiktokers, Instagram influencers, and everyone in between is sharing their knowledge (add me to the mix). Even celebrities have jumped onboard. Jay-Z, for example, gave you “a million dollars worth of game for $9.99” in his 2017 album, 4:44, where he attempts to explain the importance of credit, investing, and generational wealth. With more than a bil in the bank 😎 he reflects on what he could have done differently financially. Having come from nothing himself he empathizes with his listeners’ financial situations and tried to spread some financial lessons through his lyrical genius.

“Financial freedom my only hope

Fuck livin' rich and dyin' broke

I bought some artwork for one million

Two years later, that shit worth two million

Few years later, that shit worth eight million

I can't wait to give this shit to my children”The Story of O.J. | Jay-Z | 4:44

Off beat spin on personal finance

Most personal finance tips focus on what one should do without providing people a foundational understanding of why, the financial engine that runs our society. We all know we should save, budget, have an emergency fund, avoid debt, invest, etc. A quick google search on personal finance will give you plenty of “tips and tricks” on managing your money. But without a fundamental understanding of the financial system I believe it’s difficult to say with conviction that we are making the most sound financial decisions.

I’m neither Jay-Z, nor an influencer, nor a personal finance guru. I’m just someone attempting to level the playing field the way I know how. I’ve learned a thing or two from the fair share of mistakes I’ve made (i.e., every mistake in the book). Combined with finance concepts from Ross, risk concepts from the job, and reading personal finance books, I have developed a view on the fundamentals of finance in human society and how it affects people like you and me.

What do I get out of this? Nothing, outside of the satisfaction of someone finding this post helpful. Ok… that’s only partially true. You can always help support me! Which brings me to a few housekeeping items:

If you enjoyed this post please like ❤️ , subscribe 🔔 and/or share it with your friends!

If you’d like to chat on this topic, just say hi or give me feedback (“Feedback is the breakfast of champions.”), comment below or DM me on twitter.

I’m going to start using my twitter more actively to share off beat short-form content on finance, real estate, technology and everything in between so follow me on twitter if interested.

Before we go further I’d like to clarify that this is not in any way financial or investment advice, but more lessons I learned that I hope will be beneficial to anyone reading this.

Lets dive into it…

Realities of money personal finance

Money is not the north star

Cash is not king, but cash flow might be

Money is not the north star

Money is at the center of our lives. We earn it. We use it. From a rent check to a pint, we depend on it. But at the end of the day that piece of paper is only valuable because it is:

Something generally accepted as a medium of exchange

A measure of value, or

A means of payment

In essence it is only

Household wealth

On its own it holds no value.

All we know is that we need (more appropriately, want) more of it. Over time we learn how to make and grow our nestegg by making mistakes or learning tips and tricks along the way.

Money is nothing more than a medium of exchange in our society. It holds no value on its own. Its a promise of value and only works

The first equation I learned in business school was Assets = Liabilities + Equity, the balance sheet equation. It’s taught in the context of a company’s financial statements, but it’s very applicable to individuals’ finances. For individuals “Equity” represents an individual’s net worth.

Net Worth = Assets - Liabilities

Why is this relevant? Majority of the the world that got wealthy didn’t do so from making money through their salary. They did it by owning assets. Cash, or money, is one of many assets on the balance sheet, and, unfortunately, is the least productive of them all.

Cash is not king, but cash flow might be

“Cash is king” is a highly misunderstood phrase. Though the origin is unclear, the phrase was popularized following the global stock market crash of 1987 by Pehr G. Gyllenhammar, then CEO of Swedish car group Volvo.

The statement implies cash is the best asset in any scenario, which is far from a universal truth. That being said it does holds true in two scenarios:

Bad economic times: Pehr G. Gyllenhammar was not wrong in 1987. Relative to a steep decline in the stock market, cash in hand was a better option. This is also why the statement has been used repeatedly thereafter during the 2008 financial crisis. It is also why it holds true today. With increases in interest rates to battle inflation having liquid cash is much better than your cash losing value with the falling stock market.

Liquidity: Cash is also king because of its fundamental properties that make it the most widely accepted form of payment for any good or service:

A store of value

Unit of account

Medium of exchange

Cash is the most universally accepted form of economic exchange in human society making it the most liquid asset. It was developed as a form of exchange

This was no coincidence though. Over thousands of years we have developed a monetary system around a piece of paper that

/I hold comfort in the fact that I can buy anything

You can buy or sell any good or service with cash as long as there is an agreement on price, which is set in cash value, between the buyer and seller.

Cash sitting idle in your bank account does not grow in value and so leaving it there is actually a net loss. Cash sitting idle loses value over time because of inflation and the opportunity cost of it being used to generate money using the simple principle of compound interest.

That being said, we still need cash to buy things we need on a regular basis. The takeaway here is that cash in excess of the amount you need for your lifestyle is a net loss. That’s where the statement “cash is king” is misleading. In reality, cash flow is king. This is true for companies and for individuals.

The term cash flow originates from having checks and balances on the inflow and outflow of cash from a business. It refers to the net balance of cash moving into and out of a business at a specific point in time. Cash received is a cash inflow, while cash spent is cash outflow. Cash flow for businesses is tracked on the cash flow financial statement, which a lot of professionals would argue is the most important financial statement. Its so important that one of the most fundamental methods of valuing a company that is taught in business schools around the world is using the discounter cash flow (DCF) method. In short, a DCF analysis values a company based on its future cash flow. There are plenty of resources…

For individuals excess cash flow (i.e., cash inflow from employment, investments or elsewhere minus cash outflow for rent, liabilities, and lifestyle) is savings.

Individuals are more complicated beings and their sole purpose is not to make a profit and increase shareholder value. Nonetheless, individuals should focus on generating and optimizing recurring positive cash flow. For individuals recurring cash inflow could be dollars from a job, dividends from a stock, rent collection from a real estate investment property, trust fund distributions, etc., whereas, one-time cash events would include cash from a one-time job (e.g., freelance contract), sale of an asset (such as a real estate property, stock, bonds, etc.). Cash outflow is anything you spend your money on.

Should an individual also be valued on their free cash flows?

Generating net positive cash flow ensures you can live your life, but it is important to only keep the amount of cash you require to live your life in liquid cash.

Inflation - Prices rise, which means that one unit of money buys fewer goods and services. This loss of purchasing power impacts the cost of living for the common public

Fast-forward a decade I think focusing on managing my personal finance along with making money would have been a much much better approach.

Money is at the center of modern human society. We use it everyday, but often don’t have a grip over it. We aren’t taught about it in school, but are expected to live our lives depending on it. We need (more appropriately, want) more of it and find ways to “make” it. But what is money really? Is it as important as we make it out to be? How should we manage it? Should we be maximizing it? And if we should, how?

The problem arises when you think money = finance.

It’s easy to think that finance starts and ends at dollars.

This post will focus on the foundations of finance in modern human society as they apply to individuals covering money and everything else that I believe people should be aware of as they enter the real world. There is a

When you google personal finance there is an overwhelming plethora of information that could feel crippling - choose your own adventure.

This is my attempt to help people think about their personal finances slightly differently from the general advice that is available on the internet. I will focus on the what, e.g., “save”, “budget”, etc., but focus more on the whys.

Its crazy that we aren’t taught about personal finance in school.

Even in business school you learn about corporate finance, etc., but not about

Money is misunderstood. When we think of money we think of personal finance.

Over time we learn how to make and grow our nest-egg by making mistakes or learning tips and tricks along the way.

We’re all familiar with Darwin’s “survival of the fittest”. He explained that it is the environment or nature itself that "selects" which individuals are best adapted to it or are best "fit.” The “environment” in modern human society is governed by natural law (laws of nature) and by human law. In today’s world the “fittest”, outside of reproductary power and ability to fight of disease and survive, are those who can adapt to the manmade society that we live in where ““fitness” equates to

Fending for oneself in modern human society doesn’t equate to fighting

Money is not a resource, but a tool.

Money is not categorized as a capital resource as it is not a tool, equipment, or machinery used in the production process. Money enhances trade as it acts as a medium of exchange rather than a production machine.

No, money is not an economic resource. Money cannot be used by itself to produce anything as it is a medium of exchange for economic resources.